Following the UK’s vote to leave the European Union on 23 June 2016, and especially since the Brexit process officially began on 29 March 2017 when Prime Minister Theresa May triggered Article 50, a series of estimates and speculations have started to emerge about the future role of London as Europe’s leading financial center.

Amid Post-Brexit uncertainty, many major banks and multinational financial services firms with headquarters in the British capital are currently considering if they should move – or at least relocate a significant proportion of their staff – to another city (or cities) within the EU’s single market. With more than 350,000 employees working in the financial sector in London in 2015, this would represent important opportunities for cities in continental Europe and Ireland.

Cities on the race

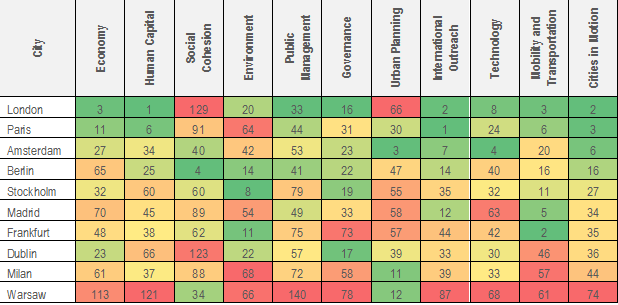

Several cities, including Paris, Frankfurt, Dublin, Madrid, Amsterdam or Luxembourg have positioned themselves as candidates to become the new European financial center. The race is on. Factors such as labor laws, the size of the financial sector, infrastructures and connectivity, human capital, quality of life or language will play a key role.

Frankfurt and Paris are two EU cities with already a significant large financial sector. Frankfurt is home to the European Central Bank, the Deutsche Bundesbank, the EU insurance authority and the Frankfurt Stock Exchange. Banks could benefit from being close to these institutions. Additionally, Germany is the largest economy in the European Union. Paris, on the other hand, is the second EU city in terms of finance sector jobs, several big banks are already present in the Paris region, and it has a good quality of life. However, both cities have labor rules often considered too rigid.

Command of English – as the language of business – is essential for a city to become a financial center. In this sense, Dublin, as the only EU English-speaking country aside from the UK, has an important advantage. Besides, it also has a similar legal system to the UK, a competitive tax regime and ranks high in ease of doing business. However, it lacks infrastructure and has a shortage of properties available for rent.

Luxembourg and Amsterdam are also on the race. Luxembourg is home to many banks and financial services firms and Amsterdam has offices of many multinational companies and it is an important transportation hub. Additionally, they are both centrally located in Europe and the English language is widely spoken, which give them an important advantage.

Madrid

In a recent article, Prof. Berrone analyzed the strengths and weaknesses of Madrid as the new Europe’s financial capital. On the one hand, Madrid has a relatively high GDP per capital and hosts the government institutions and decision-making bodies. Many headquarters of big companies – such as BBVA, Banco Santander, Repsol or Telefónica – are located in the Spanish capital, and the stock market is good. Moreover, one of Madrid’s biggest advantages is that the city has good infrastructures, affordable housing and a remarkable office stock with residential and commercial properties available for rent. Lastly, Madrid also has important tax incentives – its corporate tax system is lower than the German and French ones – and a good quality of life – with plenty of sunshine –.

Nevertheless, Prof. Berrone also noted that Madrid has some drawbacks compared to other of the abovementioned cities. For instance, the unemployment rate is high in comparison to the European average and there is a lack of diversification of foreign investment – concentrated in the building industry. Additionally, there is excessive bureaucracy for some procedures, and geographically Madrid is far from the center of Europe. Lastly, although the percentage of the population with a university degree is high, the lack of good English command among the population is still significant – which will make day-to-day procedures not easy for foreign companies.

Other cities such as Milan, Berlin, Stockholm or Warsaw are also seeking to attract London-based financial services firms and banks. However, their decision to move out of the City or not will depend on the Brexit negotiations and the final deal between the UK and the EU.

Do you think financial services firms and banks will move out of London? In that case, which European city do you think will be the winner (or winners) as the next European financial hub?

Yes the Race is on. There is very tuff competition among this because there are a lot of choices and many much big cities in Europe. But i think London or Paris would be best for it.

Are you kidding? UK is leaving EU, so how London can get it? And i can say that there will be no financial leader in EU for the next few years.

And this is quite explainable. There are a lot of big and rich cities in EU, but Europe after Brexit should concentrate not on competition, but on strengthening of the union.

There is one big leader in EU now – Germany. But they also have a lot of problems like Syrian migrants now. So as i think, we should wait few more years, and then Berlin will be the New Europe’s Financial Center.

As i think, Berlin will

I do agree to that England is no more a pivotal financial hub as after Brexit, it has to face many restrictions as well. Being the largest economy in Europe, I favor Germany for that

Difficult to say, I’d vote for Frankfurt or Paris

A really interesting text. Thanks.

It is quite an informative article. I agree with you, but I’d favor Paris over Frankfurt. Paris is favorable because of the revamped La Defense district project and at least 40% of the population speak English, which could be one of the reasons multinationals would prefer the city.

Madrid would be an excelent financial point, good location, good food, good weather

As of August 2019, it doesn’t seem like any one city is currently going to be the winner at present. Some firms are moving to Paris, some to Dublin, some to Madrid. With a no-deal Brexit still looking likely for 31st October 2019, it may be a financially gloomy Hallowe’en for the UK and bright sparks for a number of other European cities.

I think that this is a very difficult question even now.