Growth rates in emerging countries tend to be volatile and are affected by what happens beyond their borders. A recent recent study by economists at the IMF (International Monetary Fund) decomposes deviations from trend growth of emerging economies into internal and external factors. The latter include things such as global financing conditions, growth in advanced economies, and international terms of trade. On average, factors external to a country explain slightly over 50 percent of their growth rates.

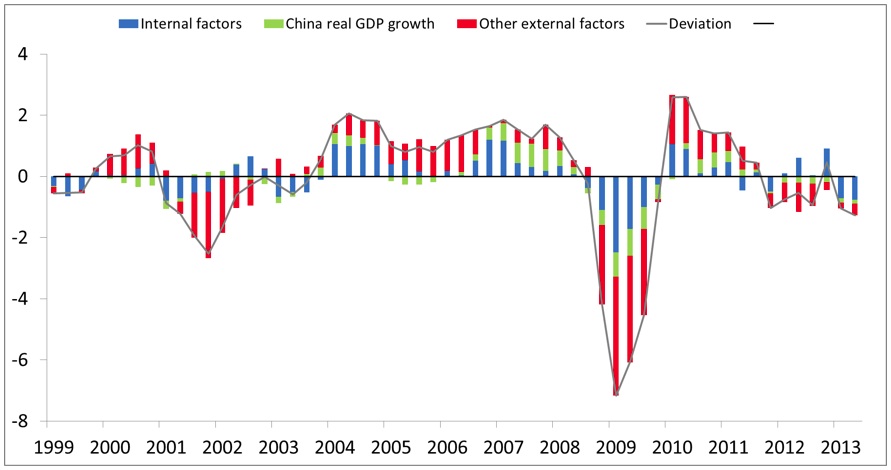

The growth rate of China is also an important external factor affecting the growth rate of emerging economies. The following figure shows the contribution of China’s GDP growth to growth in emerging markets.

1. Historical Decomposition of Emerging Market Real GDP Growth including China as an Explicit Factor

There are two periods during which the Chinese economy exerted a considerable upward pull on emerging economies. The first of these periods was in the late 2000s, right before the start of the Great Recession. The second episode was at the exit of the recession. However, starting in 2012, the effect of China on emerging economy growth has been mostly negative . With the Chinese economy slipping back to lower growth rates, demand for commodities decreased relative to the previous high-growth trend, affecting commodity-exporting emerging economies.

A point that is not addressed by the study is that the composition of commodity categories demanded by China has recently shifted. Rice has given way to higher-quality foods, such as edible oils and soybeans, and also meat. Copper and iron ore have recently lost ground to aluminum, tin and zinc. Coal is starting to be replaced by cleaner primary energy fuels.

Emerging countries heavily dependent on the classes of commodities being replaced will be most affected by these shifts in demand. A particular region to watch is Sub-Saharan Africa. Part of its growth relies on mining investment, and a shift away from copper and iron ore is likely to lead to reduced mining investment in some countries of the region, especially in those cases in which Chinese companies investing abroad are involved.