We all know that we as human beings have a hard time separating ourselves from the present situation. If we are in a crisis, we think the tough times will last for years, and the contrary if we are in an economic boom. The opinions of experts, institutes and others reflect that behavior: most of their forecasts are a mere extrapolation of the present situation. No wonder that during the recent economic crisis we were bombarded by all kinds of negative comments. Déjà vu. The same thing happened in the 1930s during the Great Depression.

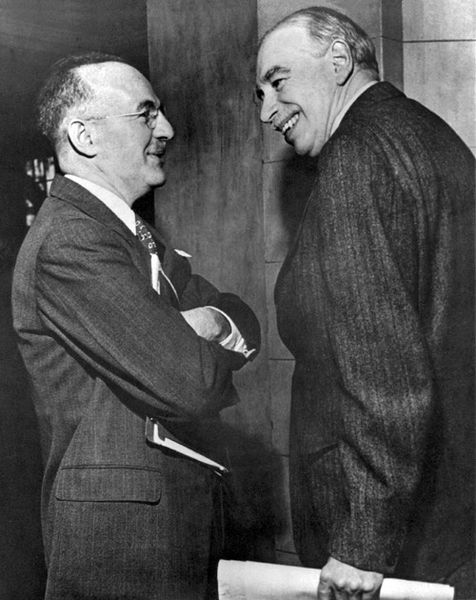

In 1930, J.M. Keynes wrote a short essay on the pessimism prevailing at that time, titled “Economic Possibilities for our Grandchildren.” Here are some excerpts:

We are suffering just now from a bad attack of economic pessimism. It is common to hear people say that the epoch of enormous economic progress which characterised the nineteenth century is over; that the rapid improvement in the standard of life is now going to slow down—at any rate in Great Britain; that a decline in prosperity is more likely than an improvement in the decade which lies ahead of us.

I believe that this is a wildly mistaken interpretation of what is happening to us. We are suffering, not from the rheumatics of old age, but from the growing-pains of over-rapid changes, from the painfulness of readjustment between one economic period and another. The increase of technical efficiency has been taking place faster than we can deal with the problem of labour absorption; the improvement in the standard of life has been a little too quick; the banking and monetary system of the world has been preventing the rate of interest from falling as fast as equilibrium requires.

The prevailing world depression, the enormous anomaly of unemployment in a world full of wants, the disastrous mistakes we have made, blind us to what is going on under the surface to the true interpretation of the trend of things. For I predict that both of the two opposed errors of pessimism which now make so much noise in the world will be proved wrong in our own time: the pessimism of the revolutionaries who think that things are so bad that nothing can save us but violent change, and the pessimism of the reactionaries who consider the balance of our economic and social life so precarious that we must risk no experiments.

My purpose in this essay, however, is not to examine the present or the near future, but to disembarrass myself of short views and take wings into the future. What can we reasonably expect the level of our economic life to be a hundred years hence? What are the economic possibilities for our grandchildren?

From the earliest times of which we have record—back, say, to two thousand years before Christ—down to the beginning of the eighteenth century, there was no very great change in the standard of life of the average man living in the civilised centres of the earth […].

This slow rate of progress, or lack of progress, was due to two reasons: to the remarkable absence of important technical improvements and to the failure of capital to accumulate.

The absence of important technical inventions between the prehistoric age and comparatively modern times is truly remarkable. Almost everything which really matters and which the world possessed at the commencement of the modern age was already known to man at the dawn of history. Language, fire, the same domestic animals which we have to-day, wheat, barley, the vine and the olive, the plough, the wheel, the oar, the sail, leather, linen and cloth, bricks and pots, gold and silver, copper, tin, and lead—and iron was added to the list before 1000 B.C.—banking, statecraft, mathematics, astronomy, and religion. There is no record of when we first possessed these things.

The modern age opened; I think, with the accumulation of capital which began in the sixteenth century […].

For I trace the beginnings of British foreign investment to the treasure which Drake stole from Spain in 1580. Thus, every £1 which Drake brought home in 1580 has now become £100,000. Such is the power of compound interest!

From the sixteenth century, with a cumulative crescendo after the eighteenth, the great age of science and technical inventions began, which since the beginning of the nineteenth century has been in full flood: coal, steam, electricity, petrol, steel, rubber, cotton, the chemical industries, automatic machinery and the methods of mass production, wireless, printing, […].

What is the result? In spite of an enormous growth in the population of the world, which it has been necessary to equip with houses and machines, the average standard of life in Europe and the United States has been raised, I think, about fourfold. The growth of capital has been on a scale which is far beyond a hundredfold of what any previous age had known. If capital increases, say, 2 per cent per annum, the capital equipment of the world will have increased by a half in twenty years, and seven and a half times in a hundred years. Think of this in terms of material things—houses, transport, and the like.

At the same time technical improvements in manufacture and transport have been proceeding at a greater rate in the last ten years than ever before in history […]. There is evidence that the revolutionary technical changes, which have so far chiefly affected industry, may soon be attacking agriculture. We may be on the eve of improvements in the efficiency of food production as great as those which have already taken place in mining, manufacture, and transport. In quite a few years—in our own lifetimes I mean—we may be able to perform all the operations of agriculture, mining, and manufacture with a quarter of the human effort to which we have been accustomed.

For the moment the very rapidity of these changes is hurting us and bringing difficult problems to solve. Those countries are suffering relatively which are not in the vanguard of progress. We are being afflicted with a new disease of which some readers may not yet have heard the name, but of which they will hear a great deal in the years to come—namely, technological unemployment. This means unemployment due to our discovery of means of economising the use of labour outrunning the pace at which we can find new uses for labour.

But this is only a temporary phase of maladjustment. All this means in the long run that mankind is solving its economic problem. I would predict that the standard of life in progressive countries one hundred years hence will be between four and eight times as high as it is to-day.

It seems that most of Keynes’ assertions proved to be correct. And the lesson to be learned from him is to look at the present economic issues with some perspective.

The text can be found here. It is taken from “Essays in Persuasion,” New York: W.W. Norton & Co., 1963, pp. 358-373.