The economies of Latin America (LatAm) have fallen on hard times. After almost a decade of positive growth, the favorable external conditions are disappearing and prospects for growth seem grim. The IMF projection for 2015 is just 0.9%, the lowest growth rate since 2002, with the exception of 2009, the year of the Great Recession.

Within the negative overall outlook, some differences can be observed: the countries of the North with closest ties to the U.S. benefit from its economic recovery, whereas the economies of South America are being hit by the slowdown in the Chinese economy . For over a decade, China has been the driving force behind the increased demand for raw materials and, therefore, the investment and export of those materials in exporting countries—pennies from heaven that directly benefited Latin America.

But this was not the only positive external factor. The region had an abundance of cheap access to credit in dollars, thanks to the expansionary monetary policies of the Fed. Also, central banks in the region did not allow the abundance of dollars to appreciate their currencies, and responded with an accumulation of official reserves and a greater supply of local currency. This increased liquidity allowed domestic companies and families to have cheap access to credit, which led to increased consumption and investment.

Today, Latin America faces the risk of a possible “dollar shock,” an increase in interest rates by the Fed, which would bring an end to the long period of abundant liquidity which has benefited the region so greatly. This would set off a dangerous reversal of capital flows, which would depreciate the local currency and seriously hinder the ability to pay off the external debt.

The prospects of the region’s countries are heavily influenced by external shocks. Mexico and most of the economies of Central America and the Caribbean are predominantly linked to the U.S. economy and thus will benefit from its galvanization. Likewise, the economies of Central America and the Caribbean benefit from the falling prices of raw materials, particularly oil.

For South America, on the other hand, the new international context is unfavorable due to its modest ties with the U.S. and a slowdown in the Chinese economy and the resultant negative impact this has on raw materials. The nations with the greatest level of dependence on direct demand from China are Chile, Brazil, Peru and Uruguay, who send 15-25% of their exports to the Asian powerhouse.

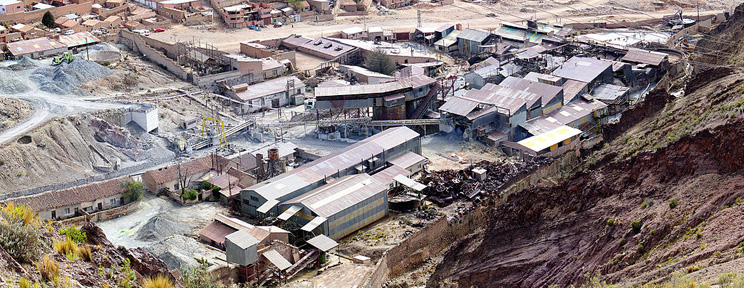

Meanwhile, since mid-2014, we have seen a collapse in the price of oil due to supply factors. The most-affected economies have been Venezuela, Bolivia, Ecuador and Colombia, whose terms of trade (price of exports relative to the price of imports) have deteriorated considerably.

Brazil, the number-one economy in the region and seventh worldwide, is also showing an alarming deterioration. Its GDP is expected to shrink by 1% this year, as a result of external shocks and domestic political instability exacerbated by the corruption scandal involving the state-owned company Petrobras. If we add to this scenario the political, economic and social chaos in Argentina, the expectations would be that the three largest economies in South America (Argentina, Brazil and Venezuela) get hit by recessions in 2015. On the positive side, Colombia, Chile and Peru have more room to maneuver with economic policy to respond to the unfavorable external conditions.

Across the board, the authorities in Latin America should closely monitor risks in the financial sector . After several years of strong credit growth, capital inflows and increased issuance of corporate bonds in the international markets, a quicker-than-expected normalization of the provisions of U.S. monetary policy, coupled with an appreciation of the dollar, could hurt borrowers with unfunded liabilities in dollars. As such, central banks should remain focused on keeping inflation within the target range and be prepared to intervene in a timely manner, and to contain the excessive exchange rate volatility.

In this context, it does not seem advisable to try to counteract the deterioration of external conditions with excessive macroeconomic policy stimulus, especially when the bulk of the positive external conditions seen in recent years were transitory.

Finally, as is customary when analyzing economic events in Latin America, we arrive at the oft-repeated morals. To lay the foundations for solid growth, attention should focus on remedying the structural weaknesses of the region, namely: the improvement of institutions, education, equality of opportunities and the business climate.

Many Latin American countries have improved their macroeconomic management and stabilized their economies, but very few have moved forward decisively with structural reforms. That is why the region grows only when it rains pennies from heaven. It has the world’s highest variability in terms of GDP growth rates. So, better to be prepared: the pennies have run out.