The global downturn that followed the collapse of Lehman Brothers in 2008 has now lasted for more than five years and the world as a whole is far from normal employment or economic activity. Even the United States, which has seen a healthier recovery than much of Europe, is still struggling with high unemployment and sluggish growth. At a recent IMF summit, Larry Summers articulated a concern that is increasingly held: What if we are “back to normal”, but the new normal is one of lackluster growth and high unemployment? The speech has received a remarkable amount of attention including from Martin Wolf and Paul Krugman.

Summers bases his worry on a few simple observations:

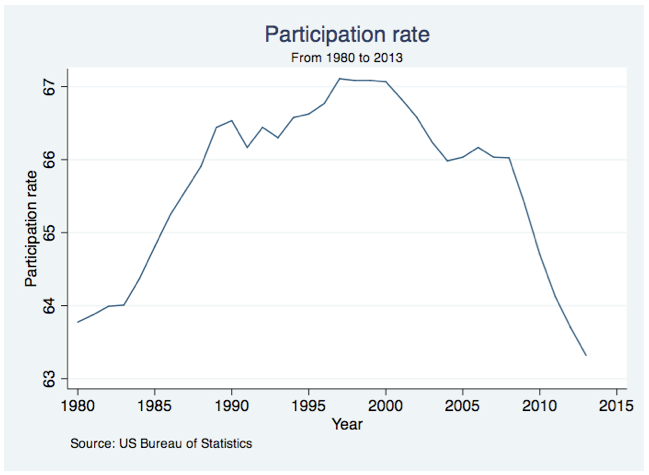

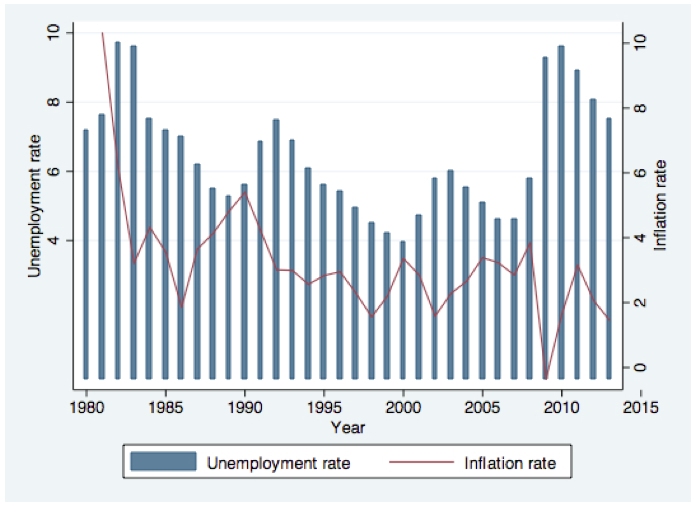

- There is almost universal agreement that in the United States the years leading up to the crisis were characterized by a boom in the real estate sector, overoptimistic lending and too loose monetary policy. Yet, even in booming times the economy didn’t show the usual signs of very low unemployment or rising inflation (see charts).

- Even though swift policy actions meant that a depression was averted, it has now been four years and the American economy is still not back at anything resembling its previous pace of growth. The share of the working age population in employment is now lower than four years ago. The economy seems to be stagnating .

This leads him to worry that the equilibrium real interest rate – the nominal interest minus the rate of inflation – has become negative over the past decade, requiring low or negative nominal interest rates, which is notoriously difficult to achieve through monetary policy (you can always put your money in cash which has a zero percent interest rate). If this is true it could imply increasingly sluggish demand, a trend that was only temporarily masked by the previous boom, but might now show its ugly face permanently. Fears are growing that the United States will experience Japanese-style lost decades of growth .

Might Summers be right? He willingly admits that his hypothesis is speculative. There are a few reasons to be optimistic and hope that he is wrong.

- First, as demonstrated in Ken Rogoff and Carmen Reinhart’s book “This Time it’s Different”, financial crises tend to lead to longer recoveries, often of up to 8 or 10 years , meaning we might have been too impatient as to expect a recovery of demand in less than five years. In many parts of the world, notably Europe, banks are still deleveraging which is imposing a drag on the European economy and consequently the world economy. A full recovery might still be a few years ahead.

- Second, the notions of “chronic insufficient demand” and “permanent negative interest rates” sit uneasily with standard economic theory. Though demand might be sluggish in the short run, prices and interest rates should adjust to ensure a supply-led economy in the long run. Further, permanent negative interest would require some peculiar assumptions (it would literally mean that the average citizen in the world would pay to save, losing 1 to 2 per cent of savings every year). Though, such concerns might seem academic and quaint, the lack of a formal theory to explore these issues makes it difficult to examine it properly.

- Third, though much hyped, Japan never experienced “lost decades” . True, GDP growth has been lacking for the past decades, but the working age population has been shrinking at the same time. Considering GDP per working age resident shows a much less gloomy picture (see Krugman’s blog for details).

Finally, much of the concern arises from a sluggish recovery of employment, which has in particular been evident in employment of the non-college educated. As I have previously argued, technological development makes it increasingly difficult for large fractions of the labor force to find employment. Though also a structural change, this is quite distinct from the hypothesis of negative real interest rates acting as systematic and chronic inhibitors of growth.

Regardless of whether Summers is right or not, it is becoming increasingly clear that the structure of the economy is changing in many ways. Understanding the causes of the current downturn is paramount for policy now and in the future .