We already knew that the economy tends to sort itself out. Not always, of course, since there are no fully automatic mechanisms, except in the field of physics. In human activities, the presence of human beings continues to be a source of irritation. Things would run so smoothly if we were all machines without our own free will, never learning or changing our behavior! That’s how some people think – and that’s how things turn out for us when they’re the ones making the decisions.

I read in an economics newspaper that Wall Street is losing steam because the good news about the (U.S.) economy strengthens the dollar. Sounds like a complaint, right? But it shouldn’t be. That’s part of the automatic adjustment mechanisms. It would be like someone getting angry if a virus or a microbe gave them a fever or an upset stomach.

Automatic mechanisms are good. When an economy accelerates the growth of the product and demand, interest rates tend to rise, due to the increased demand for credit, and its currency tends to appreciate, precisely due to the rate hike. And this slows economic growth: higher interest rates discourage the consumption of durable goods and investment, and currency appreciation slows exports and accelerates imports. The result is a more moderate growth. Without these automatic mechanisms, the economy would be a succession of violent booms and dizzying depressions .

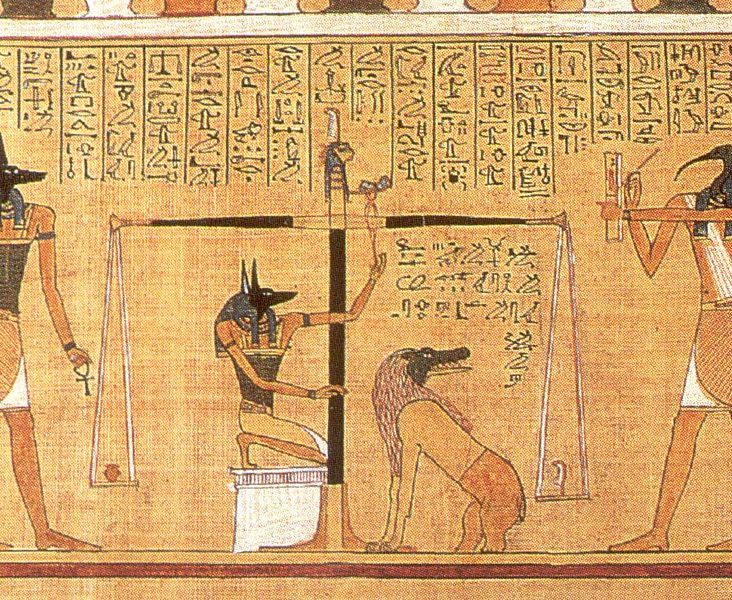

Which apparently is what some are after: to capitalize on the booms, keep them going, accelerate them, to get richer sooner. And when times get lean, we run to the federal government and the central bank to ask for new expansion measures. Anything but having patience, which it seems is not a virtue for the 21st century. The Bible already denounced the greedy who said: When will the Sabbath be ended that we may market wheat, cheating with dishonest scales?