Last Friday, Argentina saw the largest devaluation of the peso in the last 12 years, since the default in 2002 . This caused a market shakeout that brought global stock markets down and several casualties in other emerging market currencies such as the Turkish Lira or the South African Rand.

Nervousness has taken hold of many emerging markets currencies since last May when the then president of the U.S. Federal Reserve, Ben Bernanke, signaled that the Fed was considering tapering its monetary stimulus.

After the collapse of Lehman Brothers in 2008, central banks from developed economies reacted by increasing liquidity into the markets. A significant amount of it came in the form of Quantitative Easing (QE), which involves the Central Bank buying long-term bonds, driving up their prices and hence implying lower returns.

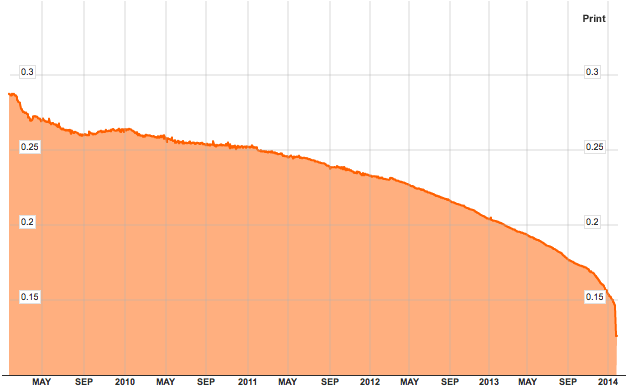

The low interest rates in developed economies lead to unprecedented capital flows into emerging markets (EM) prompted by investors looking for higher returns. With the Fed’s first talk about winding down its asset purchases and ending the availability of cheap money, capital fled from emerging economies and currencies plummeted.Meanwhile, on May 6, 2013, President Cristina Fernández de Kirchner said that Argentina would not give in to the devaluation of the peso. This forced the Argentinian Central Bank to start selling dollars and actively buying the peso. Foreign reserves are crucial since they are the currency required by their foreign creditors.

Foreign reserves reached a seven-year low having fallen by more than 31 percent and Argentina is now running out of cash to keep selling. The peso could not continue to be held high and last Friday, it took a dive.