Even after having been identified as one of the culprits of the 2007-2008 financial crisis, securitization is making a come back, with support of some central bank officials. Why?

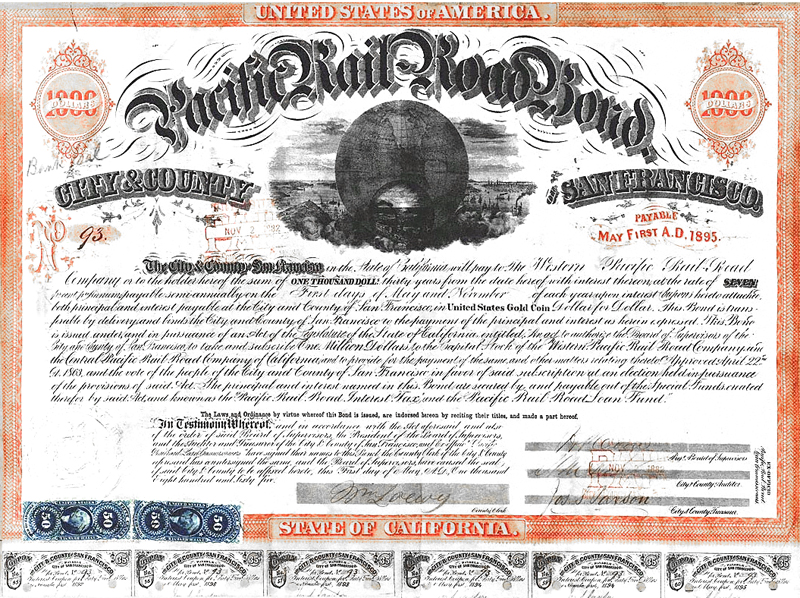

Securitization refers to the pooling and repackaging of assets in securities with claims on the cash flows generated by the asset. The final product of such pooling and repackaging of assets is denoted as asset backed security. One of the motivations for said endorsement is that securitization enables financing through capital markets rather than banks.

Its main benefit lies in shifting credit risk from banks to a broad investor base, which, as a result enables more lending. However, excessive securitization with a simultaneous misunderstanding of its risks can contribute to bad economic outcomes as we have seen in the recent financial crisis.

The Role of Securitization in the Financial Crisis

The market for U.S. residential mortgage-backed securities literally skyrocketed from 2000 until its peak in 2005. An overwhelming majority (in dollar value) of such securities was rated as AAA, the highest possible rating, and hence, evaluated as basically risk-free by rating agencies. To understand the link between securitization and the crisis one needs to understand the drivers of demand for AAA securities.

The first driver is regulatory in nature. Institutional investors, like pension funds and insurance companies, are prohibited by law from investing in securities below a certain rating. In addition, lower capital requirements or highly rated securities allow banks to sustain a higher degree of leverage.

The second driver is monetary in nature. The subprime mortgage-backed AAA tranches yielded a premium over similarly rated securities.

The combination of these two drivers, together with the fact that securitization generates fees for the financial institutions involved, resulted in a massive increase in demand in the financial sector for (sub)prime mortgages, fuelling the credit boom and the subsequent housing bubble.

Later the crisis spilled over from the financial sector to the real economy in the form of what is now known as the great recession. With this negative experience in recent memory, should securitization be vilified? Not really. What is necessary, however, is for investors to better understand the risks involved.

Residential Mortgage-Backed Securities

The overwhelming proportion of residential mortgage-backed securities rated by Moody’s between 2000 and 2007 received a AAA rating. In February 2009 more than $900 billion worth of residential mortgage-backed securities were downgraded, over $800 billion of which were originally rated as AAA. Clearly the original ratings were inaccurate.

Common risks and idiosyncratic risk events exist that might trigger the default of a given mortgage. One example of a common risk event is the decline of national housing prices. Consider a subprime borrower who has a high probability of default when his or her mortgage value is higher than the current value of the corresponding property. In this context, MBSs (mortgage-backed securities) are very vulnerable to a decline in housing prices.

Moody’s rated residential mortgage backed securities with a total value of approximately $460 billion in the first two quarters of 2007 giving the top rating of AAA to approximately $425 billion worth of tranches, despite the fact that housing prices already started declining from their peak in 2006 and many voices, including at Moody’s Economy, warned of an impending crash in the housing market.

In conclusion, when it comes to securitization, some simple robustness checks might go a very long way.

it’s good post, Thank you