A couple of weeks ago, one regular reader of this blog sent me an e-mail. He had been looking for commentaries about corruption in Africa, and he couldn’t find that many. “Why so?” was his question. And my answer: “You’re right in that I don’t talk much about corruption in my blog. The reason is that I try to focus on the positive aspects.” While corruption is a fact, it’s also a fact that not every country is equally corrupt – although to be precise, I should be talking about individuals in a country.

The non-governmental and Germany-based organization Transparency International published last month the Corruption Perception Index (CPI) for 2016. They have been publishing this index since 1995, in which they rank countries by their perceived levels of corruption, as determined by expert assessments and opinion surveys. The scale ranges from 0 (extremely corrupt) to 100 (extremely clean or absent of corruption). We focus on the performance of sub-Saharan African (SSA) countries, and analyze their relative positions as well as the impact of this index on key economic indicators.

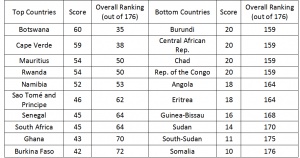

We are pleased to point out that there are 4 SSA countries among the top 50 cleanest nations worldwide: Botswana, Cape Verde, Mauritius and Rwanda. Not surprisingly, the top 10 performers in the CPI index in SSA also enjoy higher standards of living. For instance, according to the World Economic Outlook Database from the IMF, they average a GDP per capita (in $US) of $3,260 and they are expected to grow at the fastest rates, 4% on average, this 2016 (the IMF does not have the official figure for last year yet).

However, the 2 most perceived as corrupt countries in the world also belong to the sub-Saharan region: South-Sudan and Somalia. The bottom 9 countries — the IMF doesn’t cover Somalia in their database — average a GDP per capita of only $1,208. This is 2.7 times less than the top 10 performers. Further, they are expected to barely grow in 2016, 0.4%.

As the readers might have inferred, corruption perception affects many aspects of society, and it is important for SSA governments to take steps towards greater transparency. Some are taking this seriously: 19 SSA countries increased their index scores. Most remarkable are Sao Tomé and Principe, Burkina Faso and Cape Verde (+4 points). Nevertheless, 20 countries worsened their transparency perceptions last year, notably Lesotho (-5 points), Central African Republic, South Sudan, Djibouti, Mozambique, Ghana and Mauritania (-4 points).

Finally, some good news regarding some of the most populated countries in SSA. Tanzania, Nigeria (+2), Ethiopia, South Africa and Kenya (+1) have also improved their transparency index last year and they combine almost 400 million people.

Nadim Elayan, Research Assistant at IESE Business School, collaborated in this article.

___________________________________________________________________________

Related posts:

Hi Africa,

I had the perception when I started reading your posts that you didn’t talk so much about corruption and I think readers appreciated so much that attitude that you have just explained.

Development and growth of the countries will push forward better corruption indexes along next years.

Hi Jose-Pedro,

It’s a hard topic but institutions are key to foster economic growth everywhere!

Thank you Nadim & Africa for this interesting topic! I can’t wait to read the IMF report ..on corruption in Africa.

I liked your title: “Not Every Country is Equally Corrupt” … given that there are about 54 African countries, it is impossible to make generalization, as if all African countries have the same level of corruption! The use of corruption index can help businesses and practitioners to make some well-informed decisions on how to enter or exist certain countries in Africa. Yet, the use of perception alone to measure corruption may not be the only tool to understand institutions in Africa, and how each country responds/fights against corruption! More important, I think it is important to know how different foreign direct investments contribute or deter corruption in Africa! Thanks again 🙂

Thank you Aloysius,

Generalizations are a huge drag sometimes. I agree, FDIs may play an important role to lower corruption. However, we might find reverse causality issues since managers will take into account perceived corruption when deciding whether to invest in a particular country as you said before.

Thanks a lot, Africa, for this very interesant topic.

I have been trying for a long time to convince key Mexican opinion leaders to focus on the African market arguing that Mexico (and Latin American Countries) share many more values with SSA than Asia.

The level of “corruption” and “deregulation” are the key argument not to invest in SSA. Even when mentioning Spain’s “success stories” (including IESE’s) in Africa…

In an article, I even suggested to use spanish speaking Canary Islands as a platform for West Africa. It didn’t help either…

What to do? I don’t know.

Do you?

You seem to be impressed by Rwanda’s performances. Me too. However, let’s not forget that Kagame is one of Africa’s worst regime.

Keep on doing what you do in favour of Africa. One day, your efforts will be rewarded.

Thank you very much,

It is difficult to convince someone who has strong beliefs about a particular thing, even if you back your arguments with data, that is why it is important to discuss these issues more frequently. Regarding Rwanda, the article only mentions the Corruption Perception Index, not the actual corruption of a particular country (although it is clearly correlated). For instance, in Spain the Corruption Perception Index during the expansion years were clearly lower than the current one because it has not been until recently that we have discovered most of the corruption cases that took place a decade ago, and this affects at the CPI of today.

Rightly said by africa,

As title tells every country has its own corruption index. Happy read this article.

Thank you for posting this article.

Thank you very much!