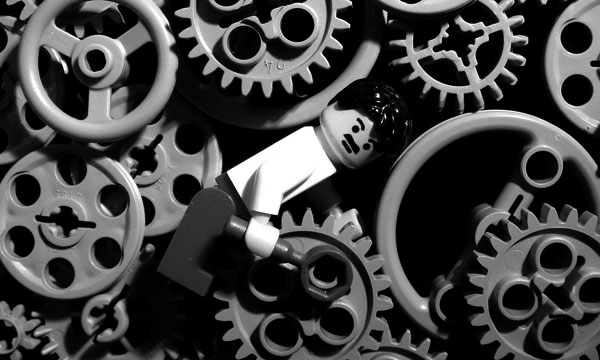

We shouldn’t be mechanistic, but sometimes we become a bit like that. Sometimes we talk about “envy” that economists feel toward physics, a science without shocks, without exceptions. We often wish economics were like that. Or at least this is what the public, politicians and the media want from us. What will happen, they ask us, if the central bank lowers interest rates by 0.25 points? How much will GDP grow next year? Well, we don’t know. And, of course, they tell us: what a disaster this science is, which can’t predict the consequences of economic decisions! It couldn’t even predict the financial crisis!

It seems to me that the uncertainty of the economy is something positive, because it means that we are free human beings, not robots, and we are limited, not perfect; that we learn, that we are capable of improving, of surpassing ourselves… and of making mistakes again. How boring life would be if all our actions were predictable, as some economists would like!

Allow me to turn to an authoritative argument, now that society – tied to its faith in science (physics, of course, not economics) – views these arguments so poorly. John M. Keynes, the famous British economist, in his Essays on Biography (1993), affirmed: “Professor (Max) Planck, of Berlin, the famous originator of the Quantum Theory, once remarked to me that in early life he had thought of studying economics, but had found it too difficult! Professor Planck could easily master the whole corpus of mathematical economics in a few days. He did not mean that! But the amalgam of logic and intuition and the wide knowledge of facts, most of which are not precise, which is required for economic interpretation in its highest form is, quite truly, overwhelmingly difficult for those whose gift mainly consists in the power to imagine and pursue to their furthest points the implications and prior conditions of comparatively simple facts which are known with a high degree of precision.”

Yes, too many of us take a mechanistic view of the economy, not only as a science, but also as a practical activity. What they try to do is say that the medicine that cured the headache of one of our relatives a couple of years ago is what we need to alleviate our own migraine today. That is, something that worked in another country a few decades ago is the ideal policy for us today. If U.S. economic policies have had success, that is what Greece should put into practice today, for example – without asking how the Greek government will pay for debt that international markets finance in the U.S. without blinking an eye.

Instead of envying physics, let’s apply this knowledge to the actions, people and institutions to which Keynes referred. The best-designed policy will fail if we don’t take into account the reaction of politicians, unions and citizens. The U.S. employment model cannot simply be transferred to Spain, not only because it fails to fit with the Mediterranean culture, but also because it does not fit with other elements of the country’s economic model such as the educational system, the housing market and the situation that retirees find themselves in today. And while the German Constitutional Court worries about possible obligations undertaken by its government due to the purchasing of government bonds by the European Central Bank, the statement that “what the Bank should do is what the U.S. Federal Reserve does” makes little sense. This is wishful thinking.

Yes, I know that politicians, the media and citizens will continue hoping for magic, mechanistic recipes to solve economic problems. But recipes do not exist because the economy is fortunately a human science, created by limited and free people, capable of disappointing even the best experts. Evidence of this is how often the conclusions of an empirical study are disproved because what worked not long ago stops working later. This is because people learned and changed, something that doesn’t happen with atoms or with the planets.

This is not a pessimistic conclusion. On the contrary, it affirms that if there are no ultimate truths in economics, then we are not condemned to anything since humans are at the center of life and have undiscovered potential. But, you have to know them well, understand what they think, what they want, what frightens them and what they hope for. After that, economics starts to be different, if only because it can converse with psychology, sociology, political science and philosophy.

Excelente post, Profesor.

Nosotros reflexionábamos en los mismos términos hace unos meses, aplicado a la disciplina no de la Economía sino del Marketing. Compartimos nuestro punto de vista por si fuera de interés:

**************

En los departamentos de Marketing estamos continuamente haciendo estimaciones: “¿Qué ventas crees que haremos de ese producto?”, “¿En qué porcentaje vas a reducir los gastos este año?”,… El problema con el que nos enfrentamos frecuentemente es que hacemos predicciones en función de los datos y los modelos que conocemos, y no somos capaces de prever lo que está por venir. Así que en muchos casos estamos condenados a obtener resultados en la línea de los actuales, ya que “siempre que pasa igual, sucede lo mismo”

Algunos visionarios se atreven a hacer predicciones mucho más arriesgadas, y por ello los errores son a veces garrafales. Así, el presidente de IBM Thomas Watson predijo en 1943 que “hay un mercado mundial como mucho para 5 ordenadores”. El New York Times se aventuraba en 1939 con otra previsión desastrosa: “La televisión nunca será un serio competidor de la radio porque la gente se debe sentar y mantener sus ojos mirando a la pantalla; la familia media americana no tiene tiempo para eso”. Su problema, que interpretaban el futuro en base a los modelos del presente, de aquel presente.

Os animo a visitar la siguiente página web donde se recogen algunas otras predicciones divertidas:

http://baetzler.de/humor/predictions.html

George Bernard Shaw describía en su obra “Back to Methuselah” la forma de actuar de los verdaderos visionarios: “Tú ves cosas y dices ¿por qué?. Yo sueño cosas que nunca han existido y digo ¿por qué no?”. Aun a riesgo de cometer errores de predicción, si no somos capaces de imaginar lo que vendrá o incluso ser partícipes en su creación, no conseguiremos grandes cambios.

Al fin y al cabo ya lo decía Nils Bohr, premio Nobel de Física: “Predecir es muy difícil, sobre todo si es acerca del futuro”

http://marketingstorming.com/2013/03/04/prediciendo-el-futuro/