These days I’m teaching a course on Managing Corporate Growth in IESE’s Executive MBA (EMBA) program. One of the issues we’ve discussed is international expansion. We touched upon the difficulties of getting data in the African context. We discussed the shortcomings of official statistics — if you follow this blog regularly, you may know that I’m a bit skeptical about official data. However, and despite my skepticism, official statistics are a starting point. And so is the Doing Business report that the World Bank releases regularly. The 2017 edition was published recently. It contains information about reforms during 2016 that make doing business in a country easier – or more difficult!

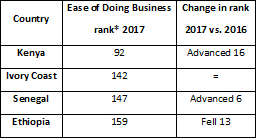

In my post of last week titled “Partnerships for growth”, I reported the countries in sub-Saharan Africa (SSA) that are growing at higher rates: Ethiopia, Ivory Coast, Senegal, and Kenya. I wondered how they are doing in terms of the Ease of Doing Business ranking. Obviously, if this has an impact on growth, it will be down the road. But still, I think it’s interesting to have a look as it may affect future business:

Some reference points:

- New Zealand occupies the first position, and Somalia the last one out of 190 countries.

- United States ranks 8th, and Spain 32nd.

- Mauritius (ranked 49th) occupies the first position among SSA countries, and Somalia (ranked 190th) the last one.

What has improved in Kenya and Senegal? These are the highlights:

Kenya:

- It’s easier to get electricity: a geographic information system has been introduced which has eliminated the need to conduct a site visit to get approval.

- The insolvency framework has been updated. Part of this reform is that the requirements for qualifications of insolvency administrators are stricter now.

Senegal:

- It’s easier to register property: the requirements to complete a property transaction are available online now, and the cadastral map has been updated.

- Banks can consult now a new credit bureau to assess the creditworthiness of consumer and commercial borrowers.

- The maximum corporate income tax collectable has been reduced.

What’s your personal experience about how easy or difficult it is to do business in any of these countries? This is important to put official statistics in the right perspective!

_____________________________________________________________________________

RELATED POSTS

Interesting conversation, Africa!

Agree … being skeptical with official statistical data, but could also be a good starting point. Based on my experience in East Africa, I am surprised why Rwanda is not above Kenya! Personally, whenever I request data from Rwanda, officials are often willing to respond.

Over the years, I have come to learn that sometimes one needs to make a physical presence to access official data in Africa, and to learn what are sector specific areas – either at minor or macro levels – that ease of doing business!

I guess, things are done differently 🙂 …. which could hinder some conventional investors to tap effectively into the African market.

Salaam,

Aloys

Hi Aloys, actually, Rwanda IS ahead of Kenya:it ranks 55 in the Ease of Doing Business ranking.

This time, I selected not the top-ranked sub-Saharan countries. Instead, I focused on those with highest GDP growth rates as reported in my previous post “Partnerships for growth.”

What is the growth rate of investment in Africa?

Hi! According to the World Economic Outlook published by the IMF on October 2016 (https://www.imf.org/external/pubs/ft/weo/2016/02/weodata/index.aspx), the Investment over GDP ratio has gone from 26.5% in 2014 to 27.8% in 2015 and it is projected to decrease in 2016 to 26.3% in the Middle East and North Africa region (the IMF does not publish data for the entire African continent). Regarding the Sub-Saharan Africa this ratio has gone from 21.5% in 2014 to 20.6% in 2015 and it is projected to further decrease in 2016 to 19.9%. The actual figure of Investment has decreased in 2015 a 7.2% in the Middle East and North Africa region (from USD 851 billion to USD 790 billion) and it is projected to decrease a 4.9% this 2016. In Sub-Saharan Africa the drop is more significant, it decreased 14.4% in 2015 (from USD 362 billion to 310 billion) and it is projected to further decrease 10.7% this 2016.

I hope you enjoy the Blog!

Regards

Thanks for providing this information, Nadim!