The 2011 report on Mobility Challenges in Emerging Markets by Cartus aimed to establish baseline practices used by multinationals in emerging locations. For the purposes of the survey, emerging markets were defined as ‘locations with infrastructure, talent, or administrative difficulties necessitating targeted strategies for meeting recruiting, housing, education, transportation, culture, language, security, and governmental challenges’.

116 respondents identified their ‘Top 3’ key emerging markets, which resulted in a list of 44 locations topped by China, India, Russia, and Brazil, the so-called BRIC countries. Hence, there is a variety of markets perceived as emerging and, as the report argues, companies have a strong need to succeed in these markets. Indeed, more than half of the respondents (51%) assessed emerging markets as more important than traditional markets. Moreover, 68% of the respondents indicated that emerging markets will remain very important to their businesses over the next two years as well.

With regard to different types of international assignment, the results show that long-term assignments are used most often in these markets (52%), followed by extended business travels (33%) and short-term assignments (32%). As we can see, the continuous use of expensive long-term assignments seems to contradict the recent trend of reducing costs, for example by focusing more on short-term assignments. As the authors of the report argue, this may indicate the critical nature of international assignments in emerging markets, and that firms perceive this high cost as ‘a fact of life in markets that lack local talent and resources’.

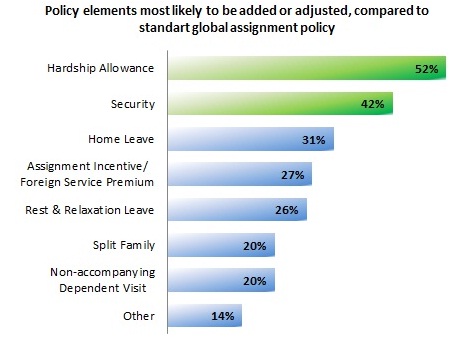

In addition to putting up with high-cost assignment types in these challenging locations, multinationals seem to accept additional costs related to attracting or retaining assignees there. 41% of the respondents reported to use more exceptions and policy adjustments in emerging compared to traditional markets. These adjustments include hardship allowances, additional incentives or home leave allowances. While the latest trends suggest a reduction of such payments for the general assignee population, these adjustments clearly continue to be relevant in emerging markets (see following chart).

* Based on Cartus 2011 Mobility Challenges in Emerging Markets report

Finally, when looking at the perceived challenges of expatriation in emerging markets respondents stated their top three challenges as follows: ‘attracting candidates with the required technical/business skills’ (51%), ‘employee’s ability to adapt successfully to the location’ (42%), and ‘lack of adequate local business and living infrastructure’ (41%). This suggests that working effectively in a challenging environment is seen as key, with less concern over financial issues, as the latter were ranked only fifth in the list.

Generally speaking, it seems that when dealing with emerging markets the question of expatriation costs becomes secondary. As the Cartus report concludes, ‘emerging markets are so critical to future business success that the actual costs fall in priority below other considerations related to getting the job done’.

love the research note, just one point, its now BRICS so please also include South Africa