From an organizational perspective, thinking about expatriation often starts with thinking about expatriate compensation. Compensation packages should attract, retain and motivate employees, while at the same time balancing these costs with the expected returns for the organization, which is not an easy task.

Although different situational factors such as the attractiveness of the assignment destination and the number of potential candidates require flexibility in compensation practices, some general guidelines and methods exist. Broadly speaking, we can differentiate between two different approaches to expatriate compensation: the balance sheet approach and the going rate approach (see Reiche, Harzing & Garcia 2009).

The balance sheet approach is the most widely used approach by organizations and its main idea is to maintain the expatriate’s standard of living throughout the assignment at the same level as it was in his/her home country. In other words, it is about ensuring the same purchasing power, which helps to maintain the home country’s lifestyle. Another important notion is that the balance sheet approach implies matching the expatriate’s salary with home-country peers, not with the host-country colleagues. On top of the home-country salary, host-country cost of living adjustments are usually made. As argued by Sims and Schraeder (2005) in their recent review of expatriate compensation practices, such adjustments are made using the ‘no loss’ approach: expatriate compensation is adjusted upward for higher costs of living, but is not adjusted downward if the cost of living in the host country is less than in the home country.

Contrary to the balance sheet approach, there is a second approach, the going rate approach, which is also known as the ‘localization’, ‘destination’ or ‘host country-based’ approach (Sims & Schraeder 2005). As these names suggest, the core of this approach lies in linking the expatriate compensation to the salary structure of the host country, taking into account local market rates and compensation levels of local employees. The going rate method aims to treat the expatriate employee as a citizen of the host country, encouraging a “when in Rome, do as the Romans do” mentality (Sims & Schraeder 2005).

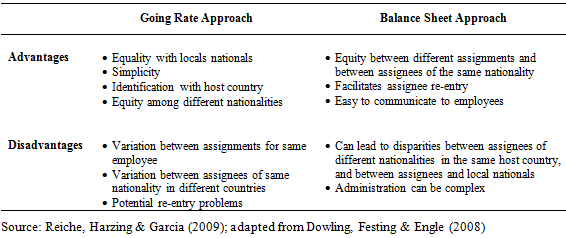

Thus, the two approaches have different foci and hence also different advantages and disadvantages (see the following table):

Apart from the stated differences in the two approaches and the related benefits and drawbacks, the going rate approach seems to be more cost-effective than the balance sheet approach. In other words, ‘going local’ may reduce the host-country market adjustment costs, which may be especially tempting for Western multinationals sending people to countries with lower salary levels. Despite these advantages, the balance sheet approach continues to be the most widely used method. According to the Brookfield Global Relocation Trends survey, 62% of respondents used a home-country approach (i.e. balance sheet approach) to determine compensation for long-term assignments, only 6% a host-country approach and 32% various combinations of home/host-country approaches. This suggests that attraction/motivation of potential candidates for assignments is clearly more important than cost saving.

However, no matter which compensation approach is used, the certain basic needs of expatriates should be still met. Organizations should not forget about the daily life challenges faced by employees in a foreign country, and hence there is a need for extra attention to security, medical care, housing, education of children, spouse matters and home trips.

In the end, it is important to consider the concept of ‘wholeness’ with regard to the goals of compensation packages. The concept refers to the organization’s desire to ensure that the expatriate does not experience an overt gain or loss when all elements of the compensation package are combined (Wentland, 2003). While finding a balance between the organization’s and expatriates’ perceptions of ‘wholeness’ can sometimes be difficult, the intentions of ‘keeping the employee as a whole’ by not letting expatriates experience drastic lifestyle changes are paramount.

Further reading:

Dowling P.J., Festing, M. & Engle, A.D. (2008). International human resource management: Managing people in a multinational context (5th ed.). London: Cengage Learning.

Reiche, S., Harzing, A.-W., & García, C. (2009). Management of International Staff. IESE Technical Note, DPON-79-E, IESE Publishing.

Sims, R.H., & Schraeder, M. (2005). Expatriate compensation: An exploratory review of salient contextual factors and common practices, Career Development International, Vol. 10(2), pp. 98-108

Wentland, D.M. (2003), “A new practical guide for determining expatriate compensation: the comprehensive model”, Compensation and Benefits Review, Vol. 35 No.3, pp.45-50.

It’s awesome in favor of me to have a website, which is helpful in support of my know-how. thanks admin

Thanks for sharing these valuable information.I am glad to read and find about balance sheet approach.

Nice table with advantages and disadvantages of approaches!

Thank you for sharing your information.