Back in October , I wrote a piece about the prospect of oil for $20 per barrel and as the scenarios is looking ever more possible, it seemed a good time to give politics a break and re-visit the issue. In its last update, the U.S. Energy Information Agency estimated that the benchmark Brent price will continue below $40 per barrel for 2016 and below $ 50 in 2017. The agency expects the other reference, West Texas Intermediate to be $2-3 lower than Brent. Within this overall framework there could be “volatility” due to questions on how fast Iran can bring its supplies into the world market.

Yin and Yang

Like pretty much everything in life, there is duality in the current low price and on the one hand it brings enormous benefits and on the other serious problems and concerns.

The benefits can be felt throughout the global economy as energy becomes cheaper across the board. In the Unites States, for example, gasoline has dropped to below $ 2 per gallon in many parts of the country and this has stimulated sales of larger more powerful cars. What is interesting is that while conventional wisdom and common sense tells us that lower energy prices should bring economic growth, there is a flurry of articles in the mainstream press saying that this time its not going to happen.

The benefits can be felt throughout the global economy as energy becomes cheaper across the board. In the Unites States, for example, gasoline has dropped to below $ 2 per gallon in many parts of the country and this has stimulated sales of larger more powerful cars. What is interesting is that while conventional wisdom and common sense tells us that lower energy prices should bring economic growth, there is a flurry of articles in the mainstream press saying that this time its not going to happen.

While I personally take some of these stories with a grain of salt, what is true is that the lower prices have hit several key parts of the global economy fairly hard and may cause a ripple effect which puts a damper on the positive benefits.

In the first place, oil and gas companies are losing billions and and have seen their share prices plummet despite massive lay offs and the cancelation or suspension of projects across the value chain.

Secondly, as discussed by in October, a number of countries around the world depend on oil revenue to fund their day to day operations and the drop is prices has placed enormous strain on a number of countries including:

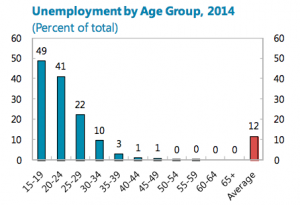

Saudi Arabia: In August, 2015, The International Monetary Fund reported that the Kingdom would run a deficit equal to 19.5% of GDP in 2015 and that if prices stay low, Saudi Arabia could exhaust its reserves in unless a “gradual but sizable fiscal adjustment” is undertaken. The problem is that Saudi Arabia has an increasing young population and the Kingdom must create jobs and stimulate the economy in order to make sure that unemployed youth does not fall prey to the terrorist ideology of the Islamic State. Meanwhile, as discussed in a post a couple of weeks ago, Saudi Arabia’s military is deeply involved in Yemen and the country is embroiled in an increasingly complex cold war with Iran across the Middle East.

Saudi Arabia: In August, 2015, The International Monetary Fund reported that the Kingdom would run a deficit equal to 19.5% of GDP in 2015 and that if prices stay low, Saudi Arabia could exhaust its reserves in unless a “gradual but sizable fiscal adjustment” is undertaken. The problem is that Saudi Arabia has an increasing young population and the Kingdom must create jobs and stimulate the economy in order to make sure that unemployed youth does not fall prey to the terrorist ideology of the Islamic State. Meanwhile, as discussed in a post a couple of weeks ago, Saudi Arabia’s military is deeply involved in Yemen and the country is embroiled in an increasingly complex cold war with Iran across the Middle East.

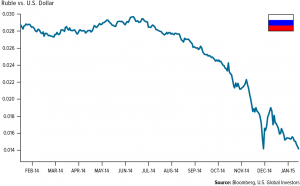

Russia: According to Russia Direct, the Russian government has deliberately allowed the Ruble to drop to unprecedented lows against the dollar to protect the Russian economy form the worst effects of the drop in oil prices. Nevertheless, oil sales account for about half of Russia’s income and with steady military expenditures in Syria and other parts of the world, Russia will need to cut its domestic spending if prices do not recover.

Russia: According to Russia Direct, the Russian government has deliberately allowed the Ruble to drop to unprecedented lows against the dollar to protect the Russian economy form the worst effects of the drop in oil prices. Nevertheless, oil sales account for about half of Russia’s income and with steady military expenditures in Syria and other parts of the world, Russia will need to cut its domestic spending if prices do not recover.

- Venezuela: OilPrice.com links the Venezuelan opposition’s victory in the recent elections in December to the low oil price which has “has shattered the economy, drained government coffers, and left the country’s currency in tatters” . A recent commission form the European Union which included representatives of Spain’s two major political parties called on Venezuela’s President Nicolás Maduro and its Parliament to break the current stalemate and start to talk with each other to address the country’s problems.

The situation in these and other countries such as Iraq, Iran and Libya can have direct geopolitical impact in terms of the different conflicts they have with each other and other countries around the world.

The last impact, which is more of a medium to long term issue, is that a very low oil price will make it even harder for the world to implement and accelerate the climate agreement reached in Paris last month as the financial cost of developing a low carbon economy will be even higher relative to business as usual with cheap oil and gas.