On January 9th, Daniel Franklin, the Editor of the Economist was at IESE and singled out shale gas and hydraulic fracking as one of the causes of the fragile economic recovery in the U.S. Last month, two groups of students in my Global Executive MBA class chose the topic for their class project and all agreed that hydraulic fracking and shale gas is a game changer and even found a song about the subject!

In the next weeks this blog will discuss how fracking works, the environmental issues involved, its current and future impact on the global energy business, and go into more depth on the geopolitical implications mentioned in passing in last week’s posting. This week’s entry focuses on the first two questions.

How it works

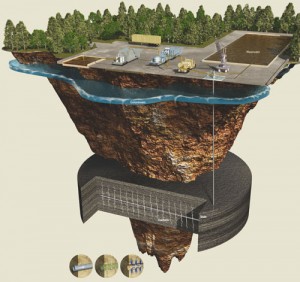

The technology of hydraulic fracking has actually been around for over 50 years and involves injecting water, sand, and chemicals into shale rock to introduce cracks into the rock and then keep them open so that trapped natural gas can come out. Operators drill very deep into the earth and then cut horizontally into the seems of rock.

The technology of hydraulic fracking has actually been around for over 50 years and involves injecting water, sand, and chemicals into shale rock to introduce cracks into the rock and then keep them open so that trapped natural gas can come out. Operators drill very deep into the earth and then cut horizontally into the seems of rock.

Depending on the location, shale gas in found 5-12,000 feet below the surface and the industry claims it is impossible for the gas to seep into groundwater which is rarely deeper than 1-2,000 feet. The issue is that oil and gas wells must perforate the ground water level on their way to deeper rocks and the way to do this is to line the well with a casing made of steel which is cemented into the surrounding geological formations. If the casing is faulty or the job has not been done properly, then gas can seep into the rock and potentially into the groundwater.

An additional issue is that when dealing with very deep structures in the earth, drilling for oil and gas can release seismic pressure causing earth tremors!

Real Problems

I n my view, the fundamental problem is that due to the “gold rush” mentality and patchwork of regulations, there has been a lot of activity all of a sudden and not all of the operators and regulators have done all they can to ensure safe operation.

n my view, the fundamental problem is that due to the “gold rush” mentality and patchwork of regulations, there has been a lot of activity all of a sudden and not all of the operators and regulators have done all they can to ensure safe operation.

Thus you get well documented reports, such as those done by Propublica, of communities with water catching fire, mishandling of the run-off from wells and badly managed toxic waste.

Show me the money

The reference spot price for natural gas in the US is found at a place in Louisiana called Henry Hub, where a number of pipelines come together. It has been hovering above $ 4 per million BTUs for the last few weeks and, I think the key issue is how fast the industry can drive the cost of shale gas down to its target of $ 2.50 and how much incremental cost will come from the comprehensive and serous environmental legalization which is needed at the state and perhaps the federal level to adequately protect people and the environment while at the same time taking advantage of the technology.

Hi Mike,

Long time no hear. Look forward following this blog.

Brgds,

Ole

Congrats Mike on the taking the plunge into blogging and sharing. Saludos de NYC.

I am always a big fan of Prof. Rosenberg. Glad to find this blog by reading his column on the Alumni magazine.