Over the last few months I have been researching a book about the link between business strategy and sustainability and an issue which comes out very strongly is the time frame that most business people appear to working with which appears to be getting shorter and shorter.

A view from Mckinsey & Co.

Working together with the Canadian Pension Plan Investment Board, Mcinskey & Company’s Senior Partner, Dominic Barton, launched an initiative last year called Focussing Capital on the Long Term, which is about getting Boards of Directors to reverse this trend.

Unilever’s Paul Poleman is a member and has not only stopped giving quarterly guidance to the financial press but has changed the nature of the company’s shareholders in order to attract the kind of capital which allows the company to set bold, long term financial and sustainability goals.

Business and the Environment

Business, in my view, has a hard time with the concept of environmental sustainability . Business is largely about making money. Environmental sustainability is about protecting the planet and the creatures (including humans) on it.

The time scale for business is measured in quarters, annual results, 3-5 year plans, etc. Climate change, deforestation, reduction in biodiversity, etc., occurs over decades or even centuries.

Its difficult to bridge the gap.

The issues that drive this sense of time are, in my view, the time value of money, the strategic planning process in many firms, the complexity of the business environment, individual career planning and the kind of people who choose a career in business who often like to see the immediate results of what they do.

The Time Value of Money

Perhaps the most obvious of these issues is the time value of money which, simply put means that most of us would rather have an amount of money, say 100 euros or dollars today, than accept a promise of the same amount in a year’s time. The basic reasons for this is that we could probably do something useful with the money if we had it today, like put it in the bank, and that perhaps a promise might not be kept.

Perhaps the most obvious of these issues is the time value of money which, simply put means that most of us would rather have an amount of money, say 100 euros or dollars today, than accept a promise of the same amount in a year’s time. The basic reasons for this is that we could probably do something useful with the money if we had it today, like put it in the bank, and that perhaps a promise might not be kept.

All of this drives many businesses to put more value on the near term financial impact of decisions and less on long term value creation. Of course there are a class of businesses, such as shipping, oil exploration, etc. which deal with long terms time frames as a matter of course and routinely look far into the future in order make investments.

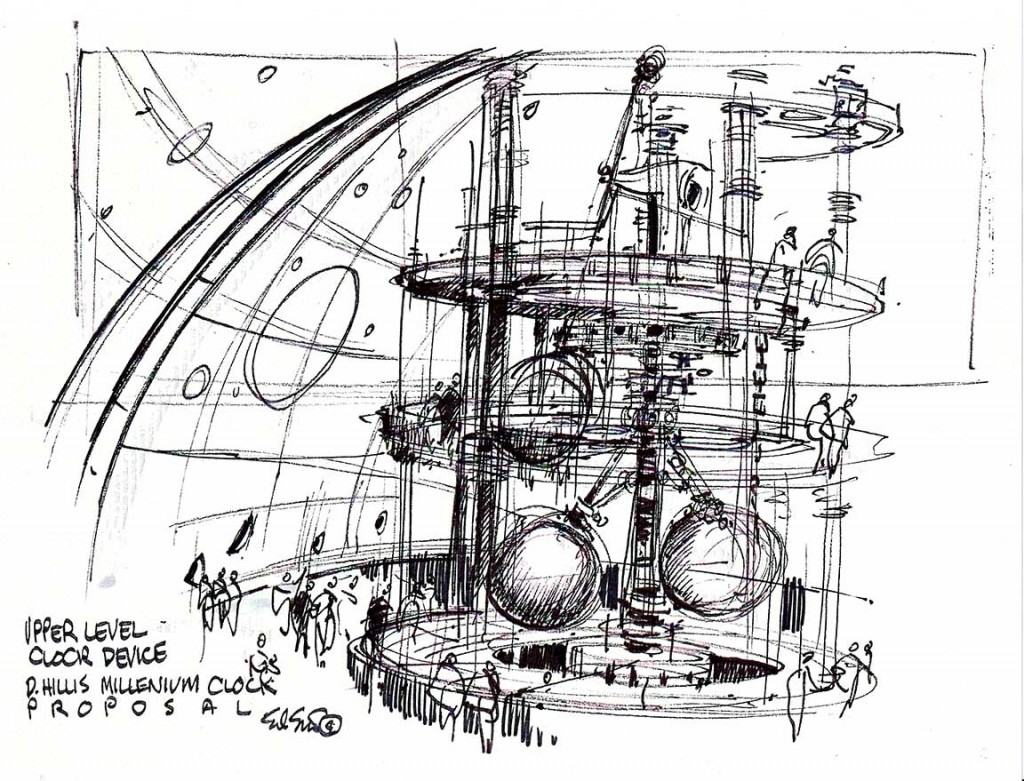

The Clock of the Long Now

By far the best example of long term thinking that I have come across in my life is the construction of a 10,000 year mechanical clock by Jeff Bezos, Brian Eno and many others in a mountain in Texas.

While a time frame of 10,000 years might be a bit long for most people in business, part of the answer in bringing the world’s of business and the environment a bit closer will be to get the time frame frame back to a more reasonable 10-20 years where proper trade off discussions and risk assessment can be made.