Last week I was in New York City teaching on our course on Managing Global Business which deals with the real issues associated with matrix organizations and took a few minutes out to speck with our New York Alumni about the link between business and geopolitics.

The thing is that many western companies are increasingly expanding their footprint well beyond the “usual suspects” of Europe, North America, and Japan. At the same time, companies with roots in developing countries such as India, China, and Brazil, are increasingly expanding across the planet.

World Market Share

In my view, this expansion is primarily about size and scale. In many industries such as personal electronics, automotive, and others there are huge economies of scale which can potentially be achieved if the company gets big enough.

In many sectors, the key issue is the requisite amount of Research & Development spending needed just to stay in the game and logically, if a company is big enough, the portion that needs to be spent as a percentage of revenue goes down if the revenue number goes up.

One way of looking at the question is in terms of working out what percentage of World Market Share is needed to have the size that will enable a firm to be competitive along the dimensions of size and scale. This can be on the order of 15-20% or even higher depending on the sector.

If one supposes that a given market is split more or less evenly between North America, Europe, Asia Pacific and the rest of the world, it becomes evident that in order to achieve 20% of the world market one would have to almost dominate one region, or be very strong in two or three.

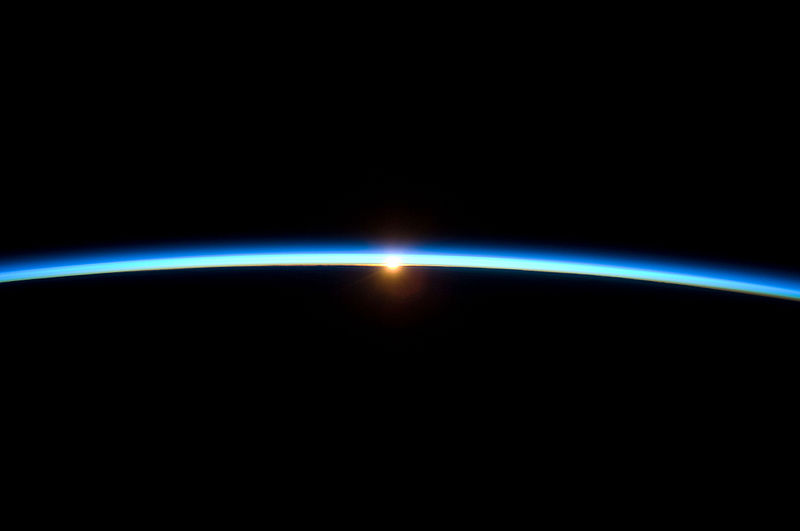

Rough Planet

As businesses increasing operate in globalized markets, their exposure to the changing nature of the world’s geopolitical balance of power has increased and at the same time, that balance appears increasingly uncertain:

- In Europe there are rising tensions with Russia as well as an ongoing political process to define what Europe is and what it will be.

- In the Middle East, the Arab Spring has evolved into a complex web of problems and contradictions including the rise of the so called Islamic State and increasing tensions between Israel and the Palestinian Authority.

- In Asia, elections have brought new leadership to Indonesia while China continues to flex its muscles in the South China Sea.

- In Africa, unprecedented economic growth is also creating tensions with local terrorist networks popping up in some countries and major conflicts between states over water and other resources.

- In the Americas, tensions continue between populist, left leaning governments in some countries and more market based politics in others while drug cartels continue to operate with impunity.

New Tools and People Needed

The point of the discussion last week was that to deal with this level of complexity, new tools were needed and perhaps new people to use them. Our traditional approach to business strategy does not, for example, include historical analysis and our approach to recruiting is long on MBAs and Finance people, and very, very short on Historians, Geographers and Political Science Majors.

When things happen around the world such as the Arab Spring and its aftermath or Russia’s Annexation of Crimea, business leaders are often surprised and caught off guard. Historians and Geographers, on the other hand, not only see these events as normal but could even, if given the chance, help companies work them out in advance developing possible scenarios and contingency plans!