Last week the first of Tesla’s new Model 3 cars began to roll off the assembly line at the converted GM/Toyota plant that Tesla bought in Fremont, California, on the east side of the San Francisco Bay. The milestone is significant both for the future of electric mobility and as a case study in how long it takes to bring new technology to market.

Last week the first of Tesla’s new Model 3 cars began to roll off the assembly line at the converted GM/Toyota plant that Tesla bought in Fremont, California, on the east side of the San Francisco Bay. The milestone is significant both for the future of electric mobility and as a case study in how long it takes to bring new technology to market.

Musk Defies the Skeptics

When Tesla was founded in 2003, few people in the automotive industry really gave it a chance. Skepticism continued as Elon Musk became the company’s chairman in 2004 and led a series of funding rounds. The first roadster, for example, was considered something of a toy when it was launched in 2007.

When Tesla bought the Fremont facility in 2010, it was pointed out that the Model S would only use a fraction of the building. Last year, Tesla produced 84,000 units of the Model S and the larger Model X, which is a far cry from the 428,000 units that the GM/Toyota joint venture made in 1997.

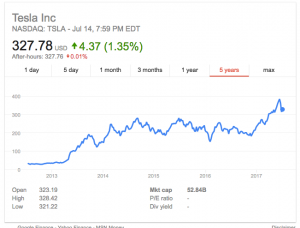

In terms of its stock market valuation, Tesla has already defied skeptics and is clearly the most valuable automotive firm in the world in terms of its value as compared to its vehicle production. As of today, the company is worth $52.8 billion, just a bit lower than BMW ($54.5 billion), GM ($55.4 billion) and higher than Ford ($47.0 billion).

In terms of its stock market valuation, Tesla has already defied skeptics and is clearly the most valuable automotive firm in the world in terms of its value as compared to its vehicle production. As of today, the company is worth $52.8 billion, just a bit lower than BMW ($54.5 billion), GM ($55.4 billion) and higher than Ford ($47.0 billion).

Of course these companies produced many, many more cars than Tesla, with BMW at 2.4 million units, Ford at 5.7 million and GM at 10 million units including its joint venture partners in China. A full explanation of Tesla’s valuation would require another post but in my view it has to do with the perception that Tesla is first and foremost a battery company and software company that happens to be making cars. In any case, the value is a testament to the vision that Mr. Musk had more than 10 years ago and to his perseverance and that of the Tesla team.

Making Money?

What is truly important about the Model 3 is that if Tesla hits its production target 0f 10,000 cars per week in 2018, it will not only defy the skeptics again but could put the company on track to make its goal of 1 million cars a year by 2020! Skeptics still do not believe these numbers as reported by Forbes and most automotive people I know are deeply concerned that Tesla is still not making any money!

In the first quarter of 2017, for example, Tesla’s net loss amounted to $330 million on sales of $2.7 billion or about $ 13,000 per car considering it sold about 25,000 cars.

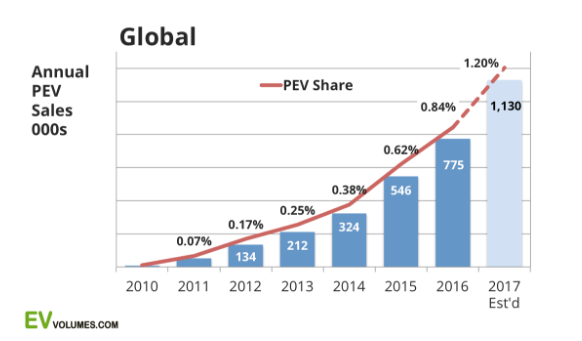

What is really at the heart of the Tesla story in my view is the role of money and investor capital in bringing new technology to market. For Tesla, and many start-ups, money is something to be used to get from one place to another like gasoline is in a car. For Tesla, the Secret Master Plan has always been to get to the mass market Model 3, and from there into the battery business. The goal is the transformation to a low carbon economy – not to build a profitable car company. For Tesla, the fact that there are literally dozens of full electric and plug-in vehicles currently on the market is just more evidence that they are moving things forward.

Tesla and its shareholders are betting that momentum for the transformation will build in terms of increasingly strict regulation of internal combustion engines, favorable tax regimes for electric cars and changing perception on the part of the world’s consumers.

Meanwhile, something like 500,000 people have already paid a deposit to receive their Model 3. These are the same type of people who buy cool products on Kickstarter and then seem happy to wait for them despite production delays. One of them is a friend and neighbor of mine who is convinced of the future of electric transportation. He expects to get his new Tesla in early 2018. I hope he does and am looking forward to driving it!

Tesla Cars can save us from air Pollution.

Tesla’s valuations is a buy in to the vision of elon musk, hope he will build a team around himself who can execute his vision when he is gone

Musk is laying the groundwork for the electric motor industry and is also ensuring that tesla gets a big chunk of it. Interesting times indeed