Three years ago at the 2017 Barclay’s automotive conference, GM’s CEO, Mary Barra announced that the company was serious about pursuing an ambitious and bold electric vehicle strategy.

To be honest, I did not take her that seriously as I have been watching General Motors as it has gone in and out of the EV business and figured this time it would follow the same pattern.

General Motors actually built the first zero-emission, fuel cell vehicle in 1964. It was called the Electrovan 1 and the fuel cells took up much of the interior space of the vehicle. In 1969, GM developed a lightweight hybrid prototype called the GM 512. This was 24 years before Toyota unveiled the Prius concept at the Tokyo Motor Show.

In 1996, GM developed its first battery-electric production car, the EV-1 in order to meet California’s zero-emission mandate but then scrapped the program (and the cars) after the mandate was relaxed.

In my view, the most exciting concept was the GM Autonomy and Hy-Wire prototypes which were shown at the Detroit Auto Show in 2002. They used fuel cells rather than batteries and essentially looked like a large electric skateboard upon which GM talked about putting a large number of body types.

In 2007, GM introduced its new concept the Chevy Volt, a series hybrid that went into production in 2010 and sold about 100,000 units before being replaced by a new version in 2016.

During all of this time, GM’s strategy for zero-emission vehicles was what I call one of depth. GM would take its extraordinary engineering talent, its money, and its scale and develop a solution that was better than anything else in the industry. At the same time, however, GM kept running the rest of its business as if the new entity did not exist.

Toyota, on the other hand, followed a strategy that I call breadth. Toyota developed its hybrid synergy drive for the Prius and then proceeded to offer a hybrid version on almost every other model they made.

Last week Ms. Barra announced that GM was going fully electric and would phase out internal combustion engines by 2035. At the heart of the strategy are a new battery pack and drive train package they are calling Ultium in typical GM style.

As always, GM has put its incredible resources on the problem and come up with a terrific solution for batteries, together with LG Chemical, and state of the art electric motors and power train components.

What is different this time, is it appears that the company is finally going to pursue a strategy of breadth in the deployment of this technology. Ultium will be used in luxury cars like the new Cadillac Lyriq, the GMC Hummer EV super truck, and according to Ms. Barra in vehicles in every configuration and price point.

If you are interested in automotive technology and GM’s transformation, I recommend watching at least the beginning of the GM presentation at the 2020 Barclay’s conference which spells it all out in tremendous detail. The Ultium power train will become part of a comprehensive platform strategy that GM has also not managed to pursue up until now.

If you are really interested in automotive technology, then I suggest you look at the introduction of GM’s new electric super truck, the GMC Hummer EV.

I fully believe that GM has the talent, technology, money, and scale to accomplish the strategy that Ms. Barra has set out. Like everything in life and business, success will depend on actually getting it done.

What I find an even more interesting question is why now? GM has had most of these ideas for years. Since then it has gone through bankruptcy, Ms. Barra’s appointment, and a steady drop in U.S. volumes over time.

and a steady drop in U.S. volumes over time.

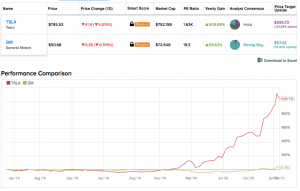

On top of that, GM has seen that Tesla, which makes less than 10% of the cars it does, has a market capitalization about 10 times larger.

If, however, the reason for GM’s transformation is to increase its share price, I am afraid they have misunderstood Tesla and its story.

Tesla is not a car company. Its mission is “to accelerate the world’s transition to sustainable energy.” This is the basic mistake that many people make when looking at the company. Cars are a means to an end and not the reason the company exists.

William Durant founded General Motors in 1908 to bring together a number of different companies that had begun building motor cars in the early years of the last century.

Over its history, GM grew to be the world’s largest manufacturer of cars and light trucks and is still a car company despite its pledge to stress electrification and mobility.

In my view, Tesla’s shareholders buy into the mission, not the cars. They are happy if the company’s cars sell and it makes a profit but are really betting on the transition to a low carbon economy and the idea that somehow, the combination of cars, batteries, and solar roofs will make the Tesla brand worth 10 times that of General Motors.

Last year, for example, Tesla made a profit thanks to its ability to sell credits to other car companies that fell behind on their emissions goals in a number of U.S. states. For automotive people, this is proof that Tesla is losing money on the cars it is making and is not a “real” car company.

For Tesla’s shareholders, however, selling credits, its acquisition of Solar City, and its investments in solar roofs are just more proof that its charismatic founder, Elon Musk is on the right track.

I applaud GM’s commitment to becoming carbon neutral by 2040 and I suspect it will be successful in the EV market once its new, Ultium based, models, come to market.

I’m not so sure that its share price will increase tenfold.