News in El País. June 14th, 2012.

“Capital flight leads to the Spanish banks to ask the ECB in record numbers”

“The central bank financing rose to 287.813 million in May”

“The dependence of the ECB than five times in one year”

Answers to El País

1.-From Oct 2011 to May 2012 the Spanish Banks have increased their use of ECB funds from €70 billion to €288. This increase of almost 220 billion is almost entirely explained by the long term facility of the ECB (LTR) injected in December 2011 and February 2012, in which the ECB injected around 1.000 billion to European banks. Spanish banks received around 220 billion. Source Bank of Spain. http://www.bde.es/webbde/es/estadis/infoest/e0801.pdf

2.-That injection of credit from the ECB is not originated because the deposits are flying from the Spanish banks.

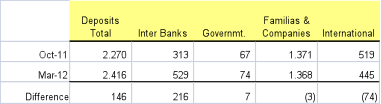

3.-From Oct 2011 to March 2012 (last data available) the evolution of deposits is the following. Source Bank of Spain. http://www.bde.es/webbde/es/estadis/infoest/a0402.pdf. Data in billion euros

4.-The interbank’s increase of deposits reflect the liquidity infection of the ECB. Deposits of families, companies and government remain stable. There is an important decrease of deposits from abroad (deposits of foreign institutions in Spanish banks). The biggest decrease of foreign deposits occurred in December and March, just when the markets got nervous and Spain became the center of attention.

5.-It must be noted that since 2010, in a period on 15 month, Spanish banks increased their equity (including provisions) from 282 to 377, an increase of 95 billion or 34%. This equity represents a 11% of the 3.523 billion assets.

6.-To have an idea of the evolution of the financing of Spanish banks we have to look at the entire liabilities + equity. Here is a summary.

7.-Again the main variations are the ones mentioned above: increase financing from ECB, decrease from international markets and increase of equity.

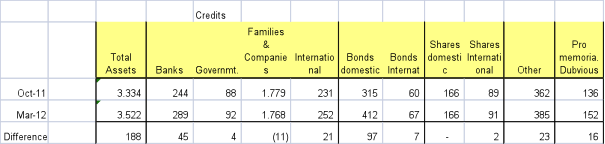

8.-To understand what happened with the 220 billion injected by the ECB we need to look also at the Asset side of the Spanish banks. Here is a summary.

9.-Main conclusions (looking only to the big variations):

- Big increase of investment in Spanish (mainly Government) bond (97 billion) which helped to appease the pressure on the Spanish public debt (the risk premium) during December to March.

- Big increase of deposits in the ECB (around 45 billion)

- Increase of other (mainly asset from defaulted loans).

10.-To summarize.

- Is there a capital flight of international investor from Spanish banks? Certainly, around 70 billion. Mont of them has occurred during the periods of bad news, Dec 2011 and March to May 2012.

- Capital flight was caused by sensational news or by the actual perception of the bad situation of the banks? Nobody knows. But the situation of the Spanish has been well known since years and the episode of capital fligh are punctual and concise the sensationalist news.

- The use of ECB funds is due to capital flight? The answer is no. … and the question is somehow sensationalist.

- The dependence of the ECB than five times in one year. Obviously. Historically Spanish banks received 50 billion from the ECB. With the last injection they received an extra 220 billion, which is few times more.

11. The 1,000 billion injection of the ECB has avoided a further deterioration of the economic situation (specifically banks and public debt) in Europe. But compared with the 2,000 billion injected by the FED in the USA in 2009, is small figure and arrives late.

12. Published opinion, whether this be real or sensationalist, has a clear effect on the mood of the investor and serious consequences on the economic situation of countries and individuals. We must be prudent.