If you have been reading the posts in this space, you already now that I agree with Christiana Figueres, the Costa Rican diplomat who led the negotiations for the Paris Climate Accord signed in 2016. Either the world will shift to a low carbon economy over the next ten years and mitigate or at least slow down the onset of catastrophic climate change or it will not.

If it does, then the transition is an enormous business opportunity and the financial rewards will go to those companies that facilitate it in terms of products, services, and new business models. What we would see in this scenario is rising sales, profits, and share prices for those companies that are involved in this transition and falling results for those which represent the current energy paradigm.

The other scenario is that we waste the next ten years like we have the last twenty. In this case, the Intergovernmental Panel on Climate Change (IPCC) has determined that it is very likely that the weather will get significantly worse. This will be experienced by even stronger storms, floods and draughts, more wild fires and increasing desertification and water stress. Eventually, perhaps in the 2030s, the world will wake up to the scale of the problem and the transition will happen anyway but it will cost more money and we will live in a world where adaptation to climate change will be urgent in many parts of the world.

One implication for business if this scenario comes to play is that the market for low carbon energy will take more than ten years to really develop. Another is that it will be sufficient to achieve targets such as becoming target neutral by 2035 or 2040 as General Motors has announced earlier this year.

As I wrote in a post last week concerning electric vehicles, looking at sales and the market share of electric cars might not show the deeper transition which may be going on in the larger ecosystem of the car business or what is called the socio-techincal regime around personal transportation.

Another way would be to look at what is going on in the world of finance and specifically amongst stock market investors. In theory, the investment community is already thinking about the medium term. There are a number of examples.

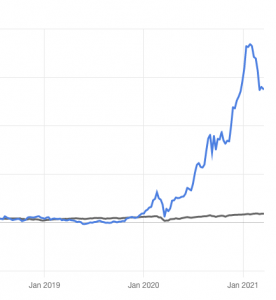

The first and foremost, of course is Tesla Motors. Today Tesla is trading at just over $ 650 per share which gives it a total value on the order of $ 628.6 Billion. The company sold around 500,000 cars in 2020 and made a profit than to re-selling carbon credits to other carmakers. Now weather you consider Tesla a car company which makes makes its own batteries or a battery company that also makes cars, the value that the market gives the company is incredible.

Just to put this in perspective, General Motors share price has increased a bit since its announcement on EV’s but is currently below $60 per share. This gives the company a value of $86.2 billion or about 14% of tesla’s. Last year GM sold something like 6.8 million cars and light trucks including its two joint ventures in China.

Another leading indicator which might change is oil company stocks. An indicator is the Dow Jones Oil and gas index which fell from a high of 6,000 in 2018, collapsed to below 2,000 in March 2020 and is currently hovering around 4.000. Exxon Mobile, for example had sales of $181 billion in 2020 and is currently trading just below $ 60 per share. This gives it a market capitalisation of $ 239.2 Billion.

You can contrast this with Schneider Electric, a company that is deeply committed to the energy transition and was named the most sustainable company in the world by Corporate Knights, a dedicated media outlet on the link between business and sustainability. In 2020, Schneider had total sales of just under $ 30 billion or less than one sixth of Exxon Mobile’s. At over $ 120 per share, however Schneider’s market valuation is $ 72 billion or just under one third that of Exxon Mobil.

By the way, if you are interested in learning more about the energy transition, the IESE student run Energy Club is holding its annual Energy Day later this week and features Schneider’s Chief Innovation Officer Emmanuel Lagarrigue as the key note speaker. The event is free of charge and you can register for the it here.