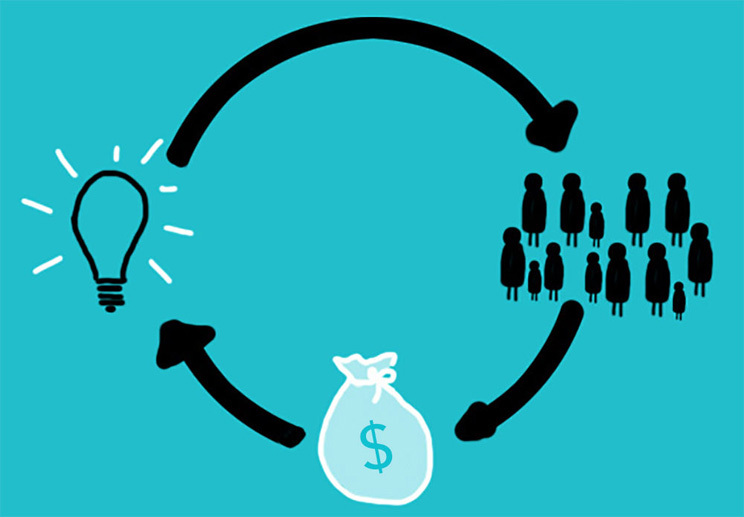

Equity-based crowdfunding, where small investors join forces and buy an ownership stake in young companies, is becoming a big business, with nearly 1.4 billion dollars invested in the United States and Europe in 2015*. Most of these transactions originated in online platforms, and recent regulatory changes are helping to attract more investors to take part in equity-based crowdfunding. If you are interested in investing in this area, I urge you to think three times before you dive in.

First, you need to think about what you are paying for. You must figure out:

- Whether you will be buying shares in the company or not (do not confuse donations with investment)

- Why you would agree to pay what the company founders are asking for (the value of the shares)

A recent story from The New York Times illustrates the problem: the founders of a US-based company raised several million dollars from nearly 100 investors, claiming that they had expertise and contacts in the oil and gas industry, which later emerged they did not have. Before being shut down by the authorities, the founders had spent most of that money, which the investors will probably never be able to recover.

Second, you need to think about what will happen following a potential investment. The issue is about monitoring the use of the invested funds, and the progress of the company in general. It is not enough to expect quarterly or annual reports: you need to figure out whether your interests as an investor will be sufficiently represented in the Board of Directors of the company at all times. See if the investment opportunity that you are interested in fits either of these criteria:

- The class of shares that you would buy as an investor should not restrict your ownership rights (not be an inferior class of shares)

- Crowdfunding investors should be able to identify the Board member that will represent their interests, or even be able to appoint a member in their collective representation.

Third, you should think about investing through intermediaries that screen companies carefully. While some investors are impressed when they see thousands of opportunities available for investment at the click of a button in online intermediaries, these may be doing a poor job with screening. You should obtain clear statements about:

- The criteria that the intermediary uses in order to screen companies

- Whether the proposed transaction satisfies all legal conditions applicable in your jurisdiction, including the information you receive about the company.

A word of warning: a recent examination among companies featured as investment opportunities by US-based crowdfunding intermediaries revealed that more than half of them were not in compliance with even the basic rules set down by the Securities and Exchange Commission.

Do not forget to find out whether you qualify to invest the amount that you are considering. This will depend on whether you are legally a “qualified investor” or not, a definition that varies between jurisdictions.

By taking the precautions explained in this article, you can feel more confident about making a crowdfunding investment.

*Sources on equity crowdfunding transaction volume: The European Alternative Finance Industry Report from Judge Business School, University of Cambridge, 2015, and CrowdExpert.com 2015 Industry Statistics.