Part 1: Sorting out the OSM Platforms

We’ve been a bit baffled. The tech and business world have recently been abuzz with stories on crowdsourcing, open innovation, Enterprise 2.0 and other web 2.0-enabled models that are about to reshape today’s business. Just a few years back — about 2005– the topic of outsourcing and offshoring dominated the public spotlight in a similar fashion, with especially heated debates raging in the US. It seems odd then that a development that sits right at the intersection of these two domains, web 2.0 and outsourcing, has so far received scant attention. In this post, we start to fill this gap.

Online Sourcing Marketplaces (OSMs) seek to harness the power of the web to enable firms and individuals to source tasks and projects from external providers or hire temporary workers. OSMs have been around since the late 1990s and today they are doing quite well – the total revenue for the industry in 2009 is estimated between $200 and $250 million. But OSMs are not at the paradigm shift point, at least not yet. Many would argue that it’s still very much up in the air whether OSMs will ever live up to their promise of transforming the way work is being done and making the “e-lance economy” a reality. We believe, however, that today OSMs may be as close to the tipping point as ever.

In 2009 we started a research project aimed at getting a better understanding of how OSMs have evolved in the past, where they stand today, and how they will likely develop in the future. We spoke to and visited all major OSM platforms, including Elance, Guru, oDesk, Rent-A-Coder, TopCoder, Crowdspring as well as a few smaller ones. Today we start a series of blog posts highlighting our key findings.

We are also in the process of launching the second phase of the project, this time focusing on OSM buyers and suppliers. If you have ever done business through OSMs in either of these capacities or if you considered using an OSM but in the end decided not to, we would love to talk to you. Please, send a short email to core@iese.edu and we will provide more details on what the participation will involve.

Back to the blog post, in the next month or so we will publish three pieces on the topic of OSM. In the remainder of the current post, will define OSMs and discuss key characteristics of OSM platforms. In the second post, we will go into more detail on OSM buyers and suppliers. In the third and final post, we will outline key challenges that OSMs are facing today and suggest how OSMs will be develop in the future. For those interested in a more detailed analysis of the OSM space, we will prepare and make available (including on this blog) a project report. This will likely be done once the second phase of the study is complete.

OSM defined

What are OSMs? We define Online Sourcing Marketplaces (OSM) as online spaces where buyers and suppliers of services can meet, offer and apply for jobs, carry out project-related tasks, and conduct financial transactions. This definition needs to be applied broadly as there exists a wide variation of practices across different OSM models. As we will discuss later, some OSM platforms offer just a few functional features included in the definition, while others go well beyond it.

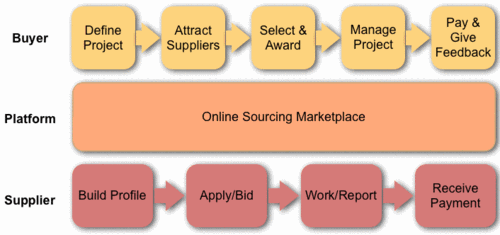

How do OSMs work? Despite the significant variation in models and practices, all OSM environments include three main stakeholders: buyers, suppliers, and (online) platforms. Generally, the interaction among the three unfolds in a manner shown in the diagram below. That is, the buyer and supplier go through the stages of their respective workflows, whereas the OSM platform connects the two.

Types of OSM platforms

What takes place within each of the stages shown above, as well as what mechanisms the platforms deploy to connect the two workflows, varies widely across different OSM environments. Based on these variations, we’ve identified three main types of OSM platforms. The key characteristics of different

| Directory | Marketplace | Community | |

| Main focus/objective | Help buyers discover suppliers by providing supplier listings with profile and contact information. | Connects buyers and suppliers in all stages of the workflow | Helps members (i.e., suppliers) to develop professionally through community interaction and paid client (i.e., buyer) engagements |

| Nature/structure of deals | Deals are done off-line. The platform is not involved. | Deals are done online, usually through a reverse auction-type process. The platform is involved in both legal and financial aspects of the deal. | Deals are done online and usually structured as contests or competitions. The platform is involved in both legal and financial aspects of the deal. |

| Platform’s role in facilitating buyer-supplier interaction | No buyer-suppliers interaction takes place on the platform. Buyers may have an option of posting projects online but all the ensuing activities take place outside of the platform. | The platform facilitates buyer-supplier interaction with focus on project completion. | The platform facilitates buyer-supplier interaction with focus on learning and community building |

| Revenue model | Advertising, sponsorship | Project commission paid by suppliers, buyers and suppliers may sign up for premium membership | Project commission/fee paid by buyers |

| Platform examples | Infolancer, Chinasourcing | Elance, Guru, oDesk, Rent-A-Coder | Crowdspring, TopCoder (Direct) |

Boundaries between different types of OSM platform sometimes get pretty fuzzy. For example, a platform may start out as a directory but, over time, add features with an objective of gradually evolving into a marketplace. Similarly, there seem to be a trend wherein platforms in the marketplace category adopt elements from the “community” category, and vice verse. For example, marketplace platforms, such as Elance and oDesk, have made significant effort to engage with and foster the community of suppliers (e.g., both maintain blogs and are active on Twitter). On the other hand, Crowdspiring, a community platform, has been diversifying modes in which deals can be structured. Recently, it added an auction-type model to its portfolio.

It is also important to note that the marketplace category in itself is quite diverse. While all the platforms share the high-level characteristics shown in table above, the focus and implementation details differ significantly from one platform to another. Elance, for example, seeks to provide buyer and suppliers with an ultimate “online workplace”. Its focus, consequently, is on building up a comprehensive tool set for project management and execution. Guru, on the other hand, concentrates on tweaking its rating and feedback system with the goal of attracting the best and brightest suppliers. Similarly, difference can be found in the approach taken by other platforms, such as oDesk, Rent-A-Coder.

In general, however, we believe that this classification of the platforms is helpful. Joining different types of OSM platforms holds significant implications for buyers and suppliers in terms the kind of counterparties they are likely to encounter, the sort of challenges they will likely to face, and the types of mechanisms the platform will provide to alleviate these challenges. In our next post, we will discuss these issues in more detail.