Lending Club’s IPO preparations mark an important milestone for Peer to Peer (P2P) lending. Since its inception in 2007, Lending Club has facilitated billions of dollars in personal loans with about $2 billion of those loans originating in 2013 alone. In essence, P2P lending websites (Prosper and Zopa are other examples) have disintermediated the banking industry’s unsecured credit market, connecting lenders and creditors directly through online platforms. While still only a tiny proportion of the overall credit market, an IPO of one of the major P2P platform makes it clear that the P2P model is here to stay and may continue to grow as an alternative way to access consumer credit.

In the early stages, entrepreneurial ventures typically do not take on substantial debt, because paying off interest limits growth as a smaller portion of proceeds are available for reinvestment in the venture. Accordingly, we do not see them systematically use P2P lending. Alternative ways to obtain financing for a new venture typically include bootstrapping through Family Fools and Friends (FFF), and investments by angels or venture capital funds in exchange for equity. Similar to the traditional banking model for consumer loans, these forms of entrepreneurial financing are experiencing changes due to the rise of crowdfunding.

Bootstrapping from Family, Fools and Friends

Crowdfunding has the potential to expand the circle of ‘fools’ and ‘friends.’ The use of online technology implies a broad reach, i.e., crowdfunding websites cater to a large number of participants at a substantially lower cost than traditional, offline-based approaches. Listing a project on a donation- or reward-based crowdfunding platform brings the idea to the attention of millions of potential financial backers all around the world.

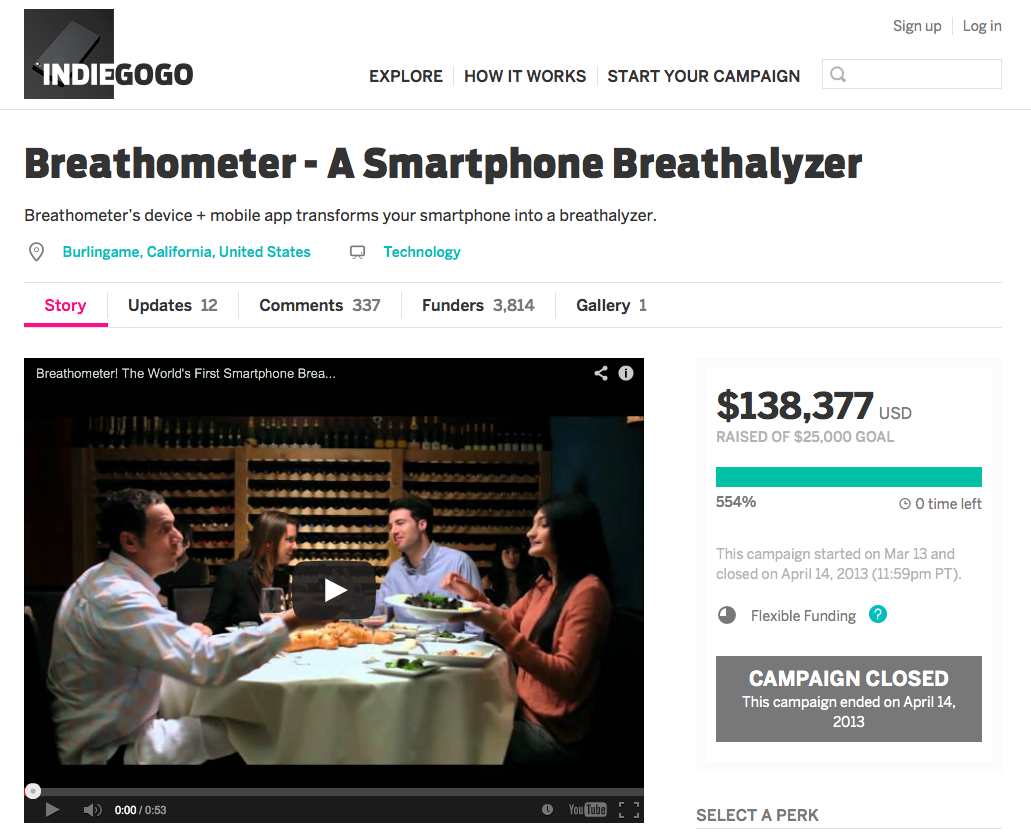

The following four entrepreneurial ventures offer an illustration of the power of the crowd in financing smaller funding targets (all were run through either Kickstarter or Indiegogo). Beyond the financial injection, these ventures were also able to demonstrate first time sales to actual customers as the rewards entailed the delivery of the venture’s products. Backers of the projects also provided substantial feedback (i.e. comments) about the products and services at very early stages of the ventures. Common to all four campaigns was that they were seeking subsequent financing from angels for further growth. To that end, all ventures made presentations and received funding from the angels of ABC’s reality show Shark Tank.

|

Crowdfunding site |

Kickstarter | Kickstarter | Indiegogo | Indiegogo |

| Funding Target |

4,500 |

9,000 |

25,000 |

30,000 |

| Funding Reached |

8,673 |

9,376 |

138,377 |

31,752 |

| New Customers |

>500 |

>50 |

>3,500 |

>100 |

| Backers |

544 |

109 |

3814 |

265 |

| Comments |

132 |

6 |

337 |

82 |

|

Shark Tank funding (TV/Reality) |

Yes/Yes | Yes/Yes | Yes/Yes |

Yes/? |

Investments from Angels

A donation-/reward-based crowdfunding campaign does not fit into the investment profile of angels, as they typically invest money in exchange for equity. In the above example, the entrepreneurs used their successful crowdfunding campaigns to gain credibility with the Sharks by emphasizing that they had already validated the market for their products and services. While all four ventures were seeking angel funding, there may be cases (when financing demand is low) where reward-based crowdfunding campaigns may substitute angel investments, as sufficient financing can be attracted online. The advantage is that entrepreneurs do not have to give up equity to the angels.

In most other cases, however, entrepreneurs require substantial additional funding, and will therefore have to consider giving up equity. More recently, equity-based crowdfunding websites have emerged that address this exact need. Seedrs and Crowdcube, for example, have already successfully crowdfunded ventures in exchange for equity and offer a sophisticated financing toolset.

While the legal framework for equity crowdfunding (both the regulation of the websites as well as the requirements for investor participation) remain subject to debate (see e.g. the World Bank crowdfunding report), equity crowdfunding seems to compete with traditional angel investments. At the same time, angel investors can themselves sign up and invest in new business using equity-based crowdfunding websites. Such participation could improve the angel’s dealflow substantially, as they can look at many ventures at the same time. Given that participation on equity crowdfunding sites is easy and not geographically constrained, we may see more eligible angels partaking in equity-based crowdfunding. Overall, this suggests that despite some potential substitution crowdfunding mostly has the potential to complement and augment existing angel investment activities.

Venture Capital Investments

A real potential for disintermediation through crowdfunding is in the VC field. The VC model relies on investor capital flowing towards VC funds, which then channel these funds towards startups. Similar to the institutional banks in P2P lending, the model in principle may lead to direct investments by the investors. At the moment, however, there is no indication that equity crowdfunding is an actual substitute to venture capital. In 2012, Occulus Rift, in one of the most successful ever Kickstarter campaigns, received pledges of about $2.4m (target was $250k). A year later, the company received Series A financing of $16M and a Series B injecting additional 75M$ (12 months later, it was purchased by Facebook for $2 billion). The size of the series A and B rounds still seem out of the scope for today’s crowdfunding initiatives.

Crowdfunding today is already shaping entrepreneurial financing. The initial change seems to affect the smaller (and potentially less profitable) market segments but in many other industries, such changes have led, over time, to substantial industry transformation (for example, the mini mills in the steel industry).

Once ambiguity about the legal framework in which equity crowdfunding operates is resolved, it will become clearer if this form of financing will continue to grow as an alternative to traditional venture capital. There is still a lot of room for innovation in the ways in which equity crowdfunding can be managed and organized but it looks like the phenomenon is here to stay, and will have a lasting effect on how entrepreneurs will finance their businesses.

Thomas M. Klueter is assistant professor in the de Department of Entrepreneurship. Prof. Klueter holds a PhD in Managerial Science and Applied Economics from University of Pennsylvania, an MA from University of Pennsylvania and University College Dublin and a BA Science from Duale Hochschule Baden-Wuertemberg.