Last week, IESE held its 34th annual conference on the state of play in the Automotive Industry together with KPMG and what impressed me most was the contrast between the past and the future which was palatable during the event and also in many of the presentations and debates.

Last week, IESE held its 34th annual conference on the state of play in the Automotive Industry together with KPMG and what impressed me most was the contrast between the past and the future which was palatable during the event and also in many of the presentations and debates.

The conference was initiated back in 1986 by Professor Pedro Nueno and Juan Llorens, an experienced Spanish automotive executive who among other things negotiated the acquisition of SEAT by the Volkswagen group. The title of the first conference was The Future of The Automotive Industry and in his remarks Professor Nueno highlighted some of the predictions that had been made at the conference that later turned out to be true.

One of the two ideas that he pointed out was the concentration that occurred in the automotive industry that he correctly foresaw. The other was the rise of China as the largest car manufacturer and market in the world. Nueno was one of the few Western intellectuals to really understand how the modernization of China driven by Den Xiaoping would re-shape the business world in general and automotive in particular.

In terms of electric vehicles, Professor Nueno has always been skeptical and he pointed out the other day how Nissan’s Carlos Ghosn had incorrectly forecasted that 20% of all new cars would be electric in 2015 when he spoke at the conference in 2010. In 2008 global sales were just over 2 million units or about 2% of the global market and they will be under 3% this year.

This year, my colleague Marc Sachon, who chairs the event, invited another speaker from Nissan, Gareth Dunsmore to speak. According to Dunsmore, Nissan sold 60,000 electric cars in Europe last year which is almost 10% of the total. Although he recognized that there is still a long way to go, Dunsmore felt that the combination of a number of new , affordable, electric cars coming to market in the next couple of years together with increased pressure on air quality and climate change will push EV’s into the mainstream.

His view is that we will see EV’s accounting for 30% or more of new vehicles in 2030 and following an exponential rise after that. The penetration of EV’s depends very much on location with sales in Norway, for example, exceeding 50% for Spain, Nissan will only managed to sell 2,000 Leafs this year.

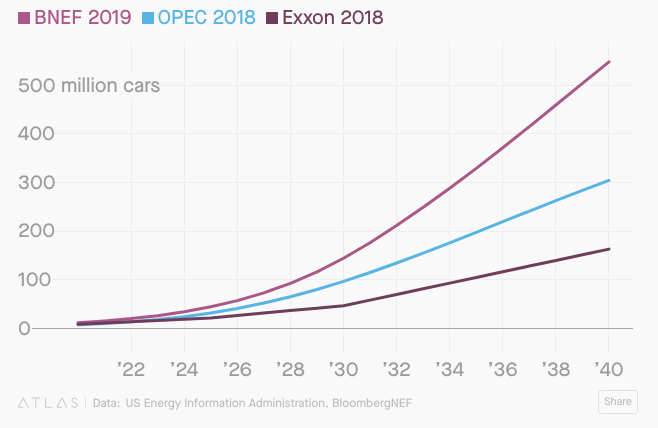

Many analysts agree with Dunsmore and see a sharp rise in EV’s in the years ahead although there is a wide variety of estimates available as reported by Quartz, a business focussed website. In the chart below, they show the latest projection of Bloomberg New Energy Finance, Opec and Exxon Mobile.

Over the years I have debated the future of electric vehicles with my colleagues Pedro Nueno and Marc Sachon and agree with Dunsmore and the estimates from Bloomberg. A few weeks ago I wrote another post on EV’s and showed the estimates from EV Outlook which are even more positive than Bloomberg in their optimistic scenario.

The main point of that post was that while I believe that EVs are happening, I do not think they will be disruptive to the automotive industry because of companies like Nissan and Volkswagen who are investing heavily in the technology.

What is not so clear to me is the impact that EVs will have on the dealer networks that sell and service most of the new cars sold all over the world. The issue is that EV’s have about one third as many components as a traditional car and while they will need to be serviced form time to time, their massive introduction will have an enormous impact on the economics of car dealers as they make much of their profit from service parts. Nissan’s Dunsmore sees a possible business for them in operating charging infrastructure at the local level.

Also speaking at the conference was Gerardo Pérez, President, of the association of dealers in Span (FACONAUTO). Pérez recognized the issue but felt that it was far in the future and that dealers would adapt. In his view the primary role of car dealers was to make local investments in the industry. His view, which I think has merit, is that dealers could emerge as a major player in providing local mobility.