The adoption of corporate venturing has increased fourfold since 2016, encouraging new trends such as venture client, fund of funds, and corporate venturing squads. Recent data reports that the value of corporate venture capital deals has hit a record high in 2020, up 24% from the year before, with major investments into e-commerce and remote working tools. Nevertheless, this environment entitles significant challenges. An opportunity or research today may easily fade in 30 days, so the corporations are under extra pressure to innovate faster with tighter budgets. Moreover, companies are struggling to bear more competitors hunting the same top-tier entrepreneurs.

This increasingly complex ecosystem is attracting additional players into the game that become key allies for the corporations’ open innovation strategy. Defined as corporate venturing enablers, these players encompass private accelerators, venture capital firms, university departments, consultancy firms, to name a few. Corporate giants such as Alibaba, Henkel, and Amazon are already innovating with startups by leveraging the capabilities of corporate venturing enablers, generating mutual benefits, and strengthening their innovation ecosystems.

The new report Open Innovation: Unlocking Hidden Opportunities by Refining the Value Proposition Between Your Corporation and Corporate Venturing Enablers sheds light on which type of enabler could be the most valuable to collaborate with, and how to seduce them with a compelling value proposition.

Who are the corporate venturing enablers?

Following the preliminary list identified in a previous study, the authors classified the enablers in six categories that have become more relevant in corporate-startup innovations:

- Knowledge institutions: research centers, university departments and think tanks.

- Boosting institutions: private incubators and accelerators.

- Investment institutions that fund startups: business angels, venture capitalists (VC) and private equity firms.

- Public institutions: government branches and embassies.

- Business institutions: other large corporations, even competitors, as well as chambers of commerce.

- Service institutions: consultancy firms offering specialized innovation support.

Exploring the mutual benefits

Based on interviews with 95 innovation leaders and 100+ examples, the report identifies the most salient benefits of enablers in their view.

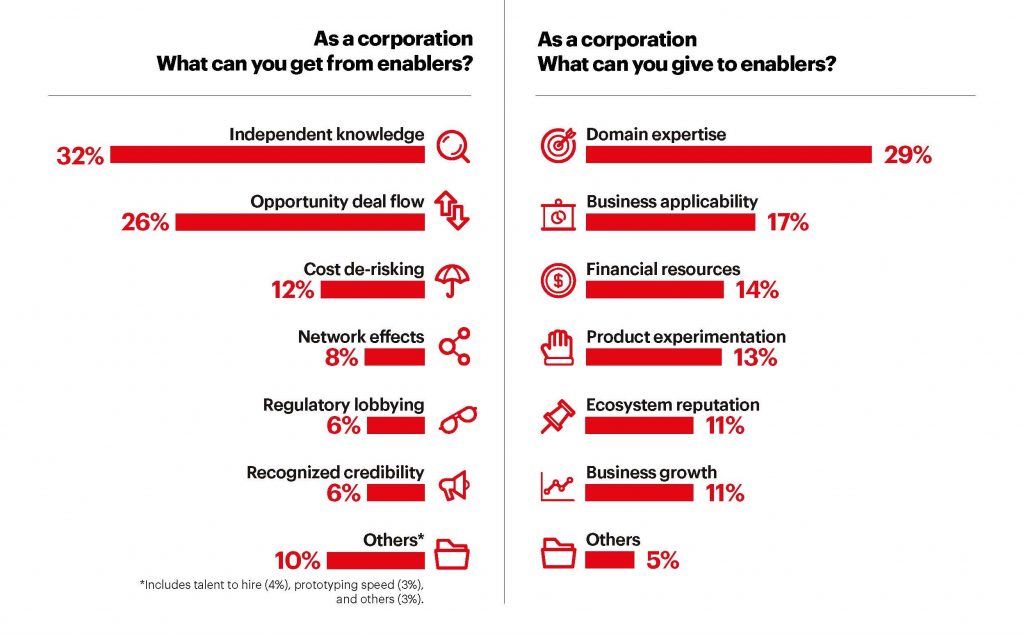

Topping the list is “independent knowledge”, understood as access to cutting-edge trends, existing know-how, regional insights, and more. For instance, the Massachusetts Institute of Technology (MIT) pairs university research teams with industry to develop solutions in the energy field. Next in line is “opportunity deal flow”, in the form of entrepreneurs in different maturity stages. There is the case of the South Korean Samsung, which used a fund of funds strategy when scouting in the Israeli market by investing in local private venture capital funds. The following benefits identified are cost de-risking, network effects, regulatory lobbying, recognized credibility, and others.

Do enablers benefit in return? Interviewees say they do, especially via corporations’ “domain expertise”- understood as mentoring, answering interviews in market analysis, being a speaker in a panel discussion, to name a few – and “business applicability” – namely, the identification of real industry challenges and understanding the industry’s strategic focus.

Lastly, interviewees also helped identify which enablers may be the best match for corporate venturing needs. For example research centers and think tanks can help gather key information, provide benchmarks, and supply proven methodologies, while seeking out partnerships with other corporations can help rein in costs such as those required for conducting a proof of concept with a startup.

Study release: 9th Open Innovation Conference

Authored by IESE’s Josemaria Siota and Prof. Mª Julia Prats, in collaboration with Vittoria Emanuela Bria, Acciona’s Telmo Perez and Cardumen Capital’s Gonzalo Martínez de Azagra, the study was presented during the 9th Open Innovation Conference held on IESE’s Madrid campus.

The event was co-organized by IESE, Acciona and Cardumen Capital, featuring two panels of industry leaders. The list of speakers included: the Chief Innovation Officers of Acciona (Telmo Pérez), Banco Santander (Manuel Cantalapiedra), Mutua Madrileña (Carmen del Campo) and Decathlon Spain (Kiko León); the Global Head of Open Innovation of BBVA (Ainhoa Campo); the Managing Director of Telefónica Ventures (Guenia Gawendo); the Global Head of Innovation X of Airbus (Christian Lindener); and the General Partner of Cardumen Capital (Gonzalo Martínez de Azagra). The moderators, from IESE, were Prof. Mª Julia Prats, academic director, and Josemaria Siota, executive director of the Entrepreneurship and Innovation Center.