Retail banking is due for a disruptive revolution. Other industries, like music and entertainment, have evolved on the impulse of technology and the process of digitization. Commercial banks, however, are still enchained, held hostage, by the paper world: it is a business that handles information—therefore digitizable—yet remains held back by the analog era.

This is largely due to an excess of regulation, which theoretically ensures security in highly sensitive transactions: “I need you to bring me the notarized deed to this property…” Couldn’t the process be integrated so that the notary could send the information electronically to the bank? Why walk around town with paperwork in our hands? Do you know anyone relatively integrated in the digital world that buys music on CD? Do you remember the last video rental place in your neighborhood to go belly up?

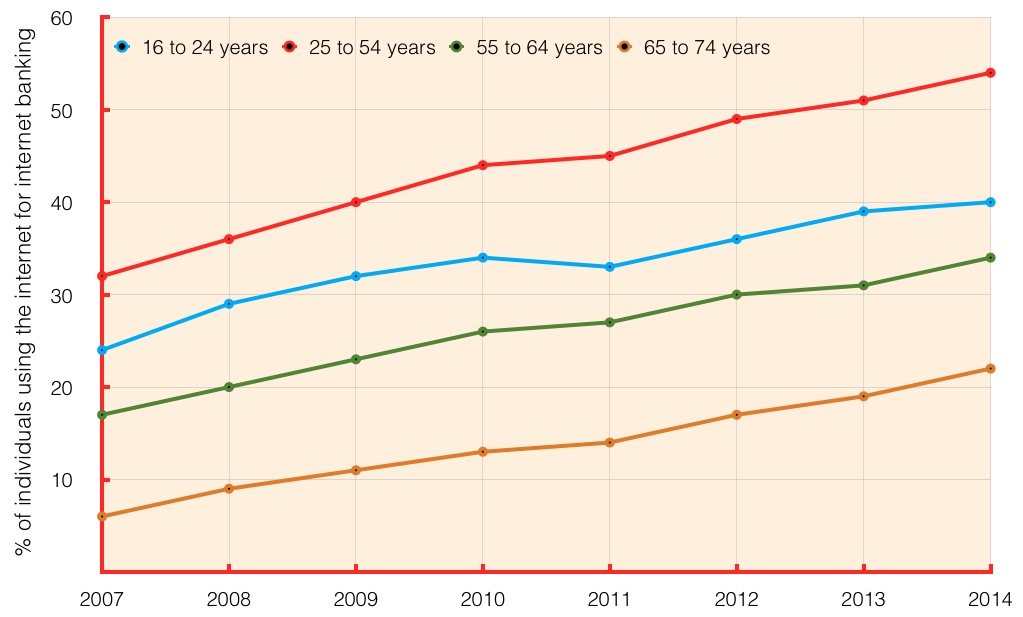

The emergence of the Internet, first and foremost, and smartphones years later, have completely reshaped consumer habits. In the European Union, for example, digital media in the management of domestic banking has undergone constant growth, especially with the explosion of the modern smartphones, even in the 65-74 year-old age bracket (22%!!).

With these data, just ask someone under 40 when was the last time they set foot in a bank… As I have lately. Only one of them told me they had been recently… to pick up a gift from a rewards program. Couldn’t it have been mailed it to their home? So, the question is: Who goes to bank branches?

- Older people, who are not accustomed to using digital media.

- Those who are required to show a physical document or sign a paper in front of an employee—processes that should be digitized by now anyway.

- Unbanked individuals who are forced to pay bills for things like utilities, must go to financial institutions to pay—with a juicy commission for the bank—the amount owed in cash.

The future of branch networks

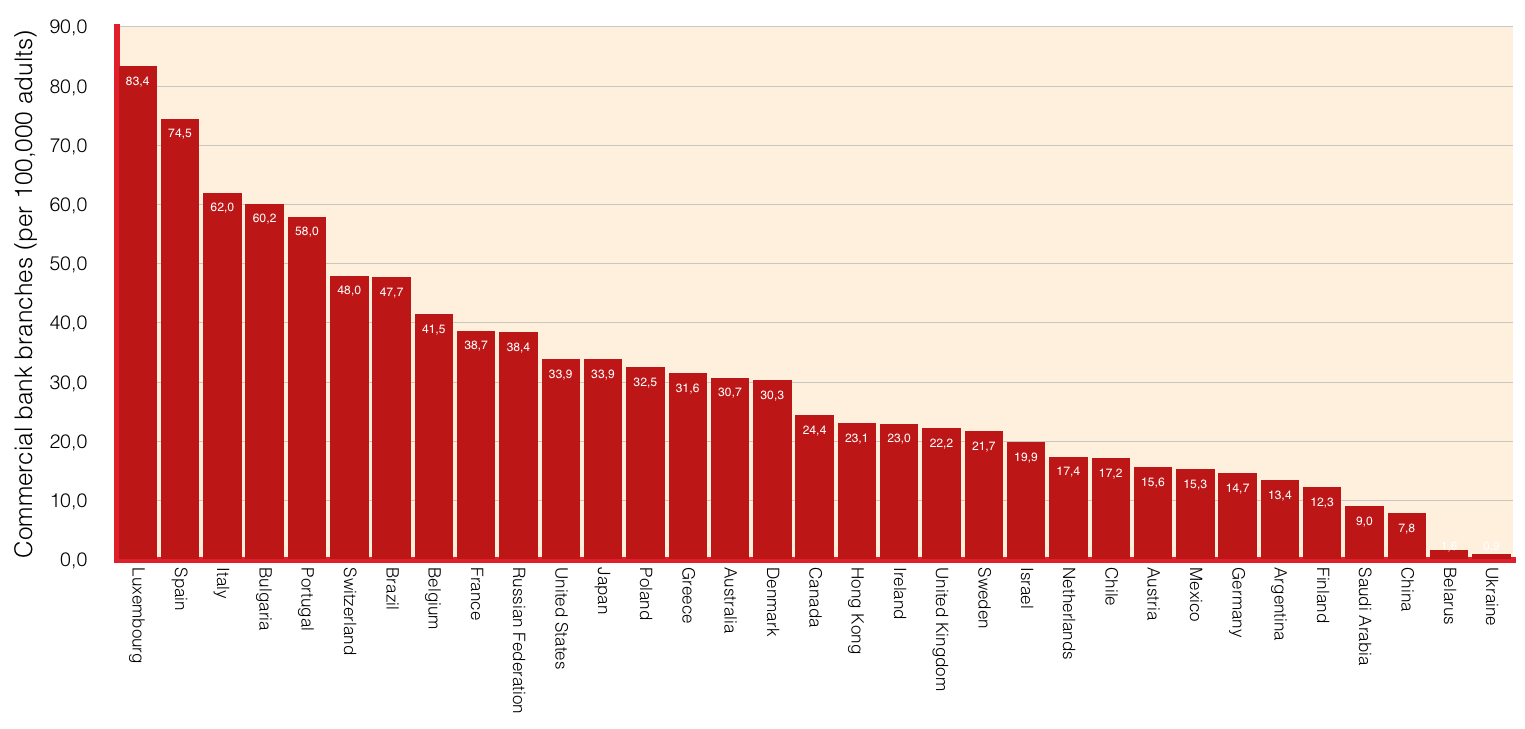

Differing from country to country, each retail banking system is its own world and the interests of the parties involved in the business are indeed diverse. The number and the concept of bank branches also varies: from the thousands of offices that exist in Spain with two employees, to large branches in other countries focused more on advising or negotiation.

The trend is that the concept of bank branches is changing radically in two aspects: First, digitization will mean going to branches only for the essential procedures. Second, branches should probably be located in high-traffic areas, like a shopping mall, for example, and should have the hours of a shopping mall. Isn’t that where people are? Aren’t those the hours that we go shopping?

As such, digitization strategy also requires a successful management of the transformation of branch networks , with everything that entails: closures, most likely lost jobs, reconceptualization of the services offered to customers, etc.

Security and trust? One advantage

The level of confidence among electronic banking users is high enough to discredit the argument that security is preventing this oncoming revolution. A study recently carried out by Accenture in the United States and Canada asks respondents: Which type of company do you trust most with securely managing your data on your behalf? Compared to other actors in the digital realm, banks inspire far more trust (86%) than any payment provider, cellphone carrier, online retailer…

This level of trust becomes a clear competitive advantage for retail banking over other companies that are vying for a piece of the retail banking pie. Security is an excuse. The technology already exists. Using a smartphone and biometric system it should already be possible to authorize bank transactions.

The challenge: to attract customers with enticing products and services

But the digitization of retail banking faces the challenge of trying to understand what digital customers want in order to give them a satisfactory experience. And all around the world there are business models of traditional banks trying to not be displaced by the so-called disruptive agents that are knocking at the door of the banking industry.

New integrated services, attractive products, leveraging social networks, etc. These are some of the formulas being used by the traditional players in the sector to try and keep pace with the customers and technology, while at the same time trying to generate new revenue streams and improve their efficiency.

But the question is: Can banks free themselves from the old shackles? The key to their future strategy lies in the aspects of how and when.

It will be a good revolution in banking sector as it has been for many other sectors. This will increase efficiency of the banking processes, but online security is a threat.

Looks like it came its time to digitize all aspects of life, including banking

Retail banking has the challenge of integrating different services in order to give a global offer to their customers. However, in my opinion, it implies to digitalize other sectors, such as public administration. In some countries it will take a long time… There is an exception: the taxes.