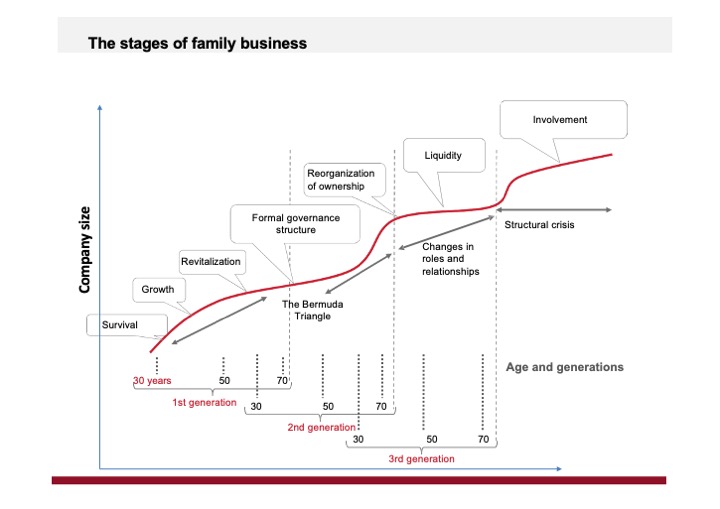

In a previous article, we analyzed the key hurdles faced by family businesses based on their life cycle. In this post, we’ll turn our focus to the challenges they encounter in their transition from the second to the third generation and beyond.

The second generation: reorganizing ownership and managing divergent interests

After successfully navigating the transition from the first to the second generation—already a significant achievement—the family business continues to face challenges related to its ownership structure and the evolution of family dynamics.

At this stage, siblings assume control of the company. Divergent interests sometimes emerge when there are significant age differences between them. Older siblings may already be considering the transfer of ownership to the third generation, while younger members typically prefer keeping the firm under second-generation control.

This scenario requires exceptional negotiation and management skills, since perspectives can easily lead to destructive conflicts.

As the chart clearly indicates, ownership reorganization, liquidity provision and the formalization of corporate governance systems are fundamental during this phase.

The 3rd generation: the consortium of cousins

With the arrival of the third generation, the web of family relationships expands from siblings to cousins, adding a new layer of complexity.

The common “what Dad would have done” benchmark in uncertain times no longer suffices. During this stage, common challenges include:

- The risk of fragmentation in a consortium of cousins with diverse interests and priorities

- High-pressure liquidity needs of increasingly extensive family branches

- Company revitalization to maintain the firm’s attractiveness and commitment among third-generation members.

At this stage, the need to formalize governance and management systems beyond the family circle is critical. It’s the only way to effectively coordinate owners who don’t share a similar age, life experiences or relationship with the company.

The 4th generation: the structural crisis

In the fourth generation, these common challenges are amplified. Company owners are no longer cousins, but second cousins, which weakens natural cohesion.

At the stage, we’re talking about a structural crisis:

- Keeping distant relatives united and committed is a major challenge.

- The ownership structure begins to resemble that of a publicly traded company, with shareholder dispersion. Yet in family businesses, there is far more at stake: beyond financial results, family firms are also dealing with emotions, shared memories and connections inherited from the past.

From the second to the fourth generation, the family business requires a shift from trust-based relationships to professional management and formalized governance.

The chart illustrates this clearly: survival, growth and revitalization are not just business phases, but also family adaptation processes.

Each successful transition is not only an economic success, but also a testament to resilience and family cohesion.

Homepage image: Kanhaiya Sharma · Unsplash